We are living and investing in a very uncertain and constantly changing environment. Any views we put on paper can be redundant within a day or two as we see yet another set of extraordinary measures from governments and central banks to support the economy and businesses to get through this awful period and return to some level of normality. However, you as investors still want to be updated as frequently as possible and our aim as a multi-asset team and firm is to ensure we keep you abreast of what we are doing in the portfolio as often as possible, without overload.

As investors many of you are aware that we have had very little duration in the Threadneedle Global Multi Asset Income Fund portfolio for a number of years now, rather investing our “dry powder” in light-duration assets such as short-term UK government bonds, cash and short-dated UK investment grade credit in the belief that these offer better protection than long-dated fixed income. The duration we have held has mainly been focused in US Treasury Inflation-Protected Securities (TIPS), where we have opportunistically taken allocations; firstly back in 2015, before exiting in early 2016, and re-entering in December 2016.

Our aim at that point was to build the allocation around the 1-1.2% and then we sold a portion of the allocation at 0.7%. Since the end of January 2020 where the allocation was 6.8% we halved the position at an average sale yield of around 0%. Post this, the US 10-year Treasury Inflation Index (TII) yields dropped to -0.51% before rising above 0.7%, then falling again.

Figure 1: Historic us 10-year tii yields

Source: Bloomberg, 23/3/2020

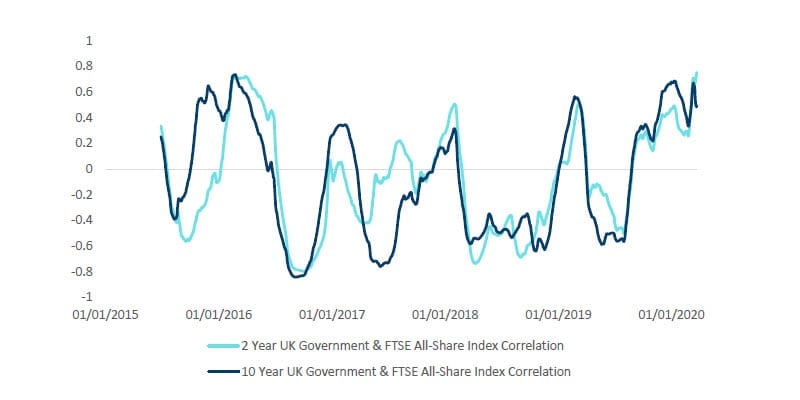

The moves we have seen in markets have been startling, but even more so the volatility we have seen in what is considered to be risk-free US government index-linked securities. This with the background of rising correlations across asset classes has meant that there are not many places to hide, so the traditional role of diversification of long-dated fixed income to equity holdings are challenged. This is a view we have held for some time, albeit we got here not through an expected route. Rather we look to use cash as the defensive position within the Fund (at the end of February we held over 20% of the Fund in cash and less than one-year UK government fixed income).

Figure 2: UK government bond/equity correlation

Source: Bloomberg, 23/3/2020

However, we still have exposure to risk assets and these have hurt performance. We have not taken any kneejerk reactions to market movements; rather, we have stuck to our multi-asset process that has been in place since the inception of the firm and has witnessed many crises before. This has meant that over the past couple of weeks when risk premia have been increasing, we have been stepping in to buy some of our favoured equity regions at what we see as attractive valuations, albeit the overall equity allocation within the fund has fallen.

We do not know when the bottom of the market will be and so we have been patient with these increases taking our time, engaging with our wider equity, fixed income, commodity and property colleagues ensuring that as ever the whole collective thought and views of the firm is driving what we are doing.

To end as we started, we will continue to engage with you as clients as our views change and from a personal perspective all stay safe.