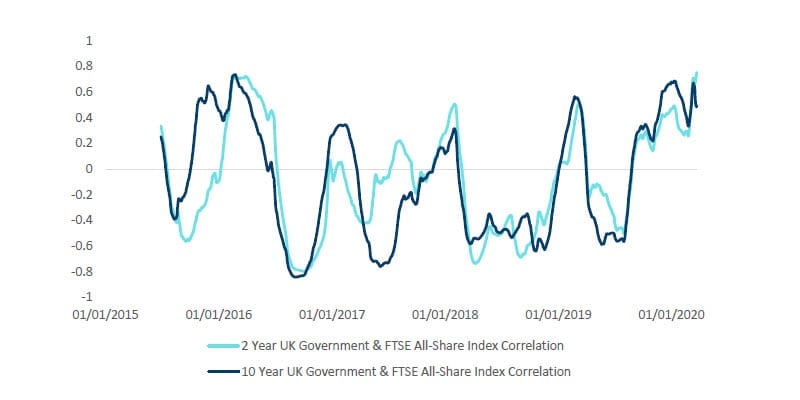

Figure 2: UK government bond/equity correlation

Source: Bloomberg, 23/3/2020

However, we still have exposure to risk assets and these have hurt performance. We have not taken any kneejerk reactions to market movements; rather, we have stuck to our multi-asset process that has been in place since the inception of the firm and has witnessed many crises before. This has meant that over the past couple of weeks when risk premia have been increasing, we have been stepping in to buy some of our favoured equity regions at what we see as attractive valuations, albeit the overall equity allocation within the fund has fallen.

We do not know when the bottom of the market will be and so we have been patient with these increases taking our time, engaging with our wider equity, fixed income, commodity and property colleagues ensuring that as ever the whole collective thought and views of the firm is driving what we are doing.

To end as we started, we will continue to engage with you as clients as our views change and from a personal perspective all stay safe.