Key takeaways

- Understand the purpose of derivatives

- Distinguish between different types of derivatives

- Understand how derivatives are settled

- Recognise the use of derivatives in portfolio management

The purpose of derivatives

The underlying assets

For asset managers, derivatives are typically used for the following purposes:

1) To hedge positions in a portfolio to reduce risk

2) For efficient portfolio management (EPM) to reduce costs

3) To gain exposure to the directional movement of an underlying asset

4) Income generation

5) To give leverage to portfolios.

Types of derivatives

‘Over the counter’ (OTC) derivatives

Exchange traded derivatives

- In June 2022, the total notional amount outstanding for Over the Counter (OTC) contracts in the derivatives market was about $632tn (OTC derivatives statistics at end-June 2022 (bis.org).

- By contrast, the global bond market is estimated to be about $133tn, and the value of stock markets globally slightly less.

Buying and selling derivatives

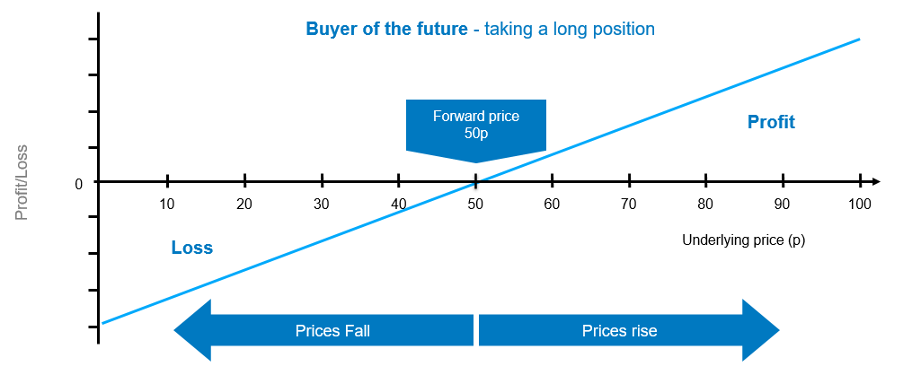

Long position – buy

If you are the person buying a derivatives contract, then you are on the long side of the contract. Simply referred to as going long

Short position – sell

The four main categories of derivatives

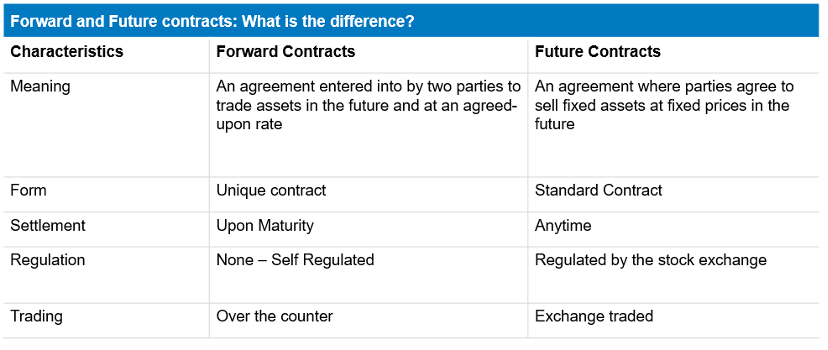

1. Forwards

2. Futures

3. Options

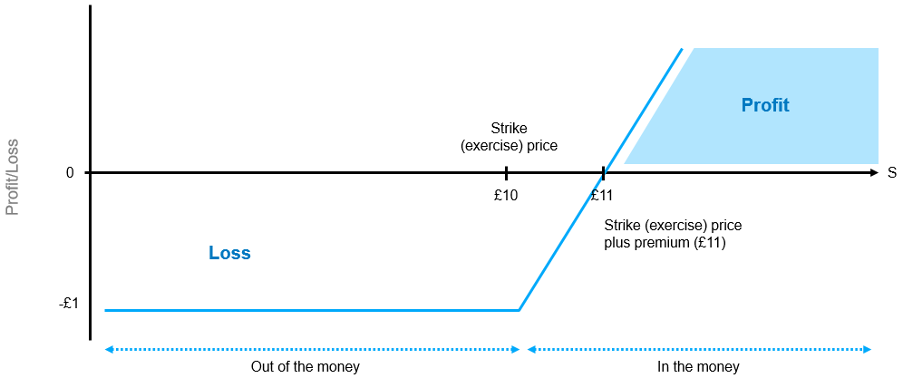

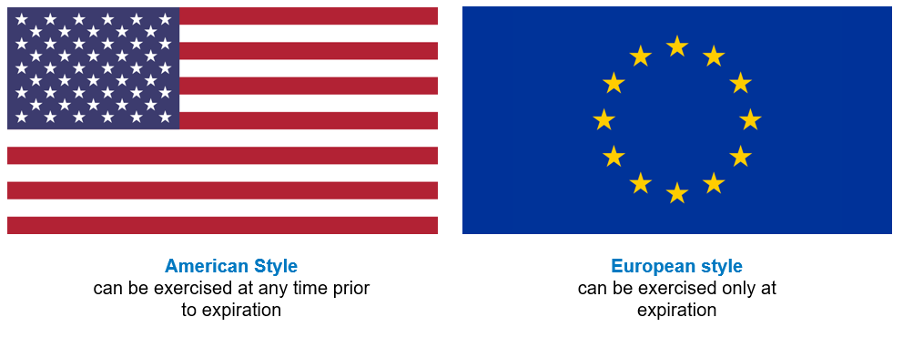

Options are similar in many ways to futures. But there’s a crucial difference. Under a futures contract, the buyer (or long) and seller (or short) are obliged to buy or sell, respectively. An option, as the name implies, does not impose such a rigid condition. Rather than an obligation to buy or sell, an option provides the right to buy or sell (depending on whether you are long or short).

Strike price – The price at which an underlying security can be purchased or sold when trading a call or put option, respectively. A known price when an investor initiates the trade.

Profit/loss for a buyer/holder of a call option – buyer expecting market to rise