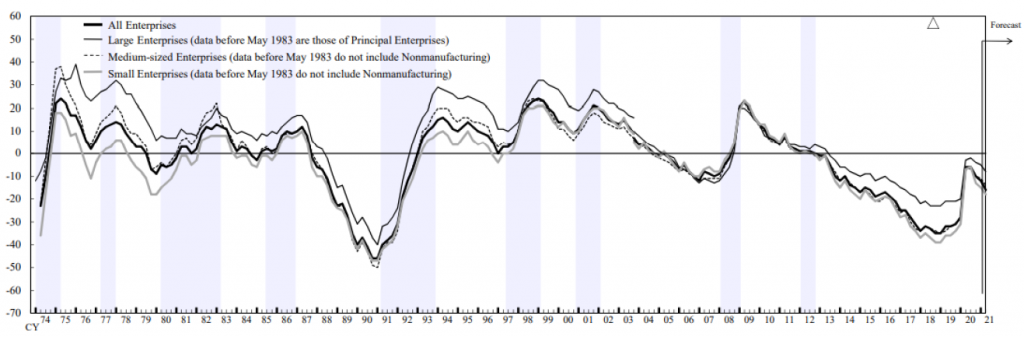

However, when it comes to software there are many examples that highlight how the country has fallen well behind the rest of the world (Figure 1). According to Gartner1, Japan is seven years behind the US in the adoption of cloud computing technology. It predicts that by 2022 14% of US IT spending will be on cloud services. In comparison, the level for Japan will rise to just 4.4%, up from 3% in 2019. In addition, the IMD World Competitiveness Ranking (2020) put Japan 27 in digital competitiveness2; in 2018, penetration of software-as-a-service (SaaS) products against the overall accounting and HR software market was just 14% in Japan versus more than 50% in the US3; and in 2019 spending on customer experience and relationship management (CRM) software was three times higher in the UK and five times higher in the US than in Japan as a percentage of overall sales and marketing expenses.4

Figure 1: Japan’s digital scorecard 2020

Times are changing

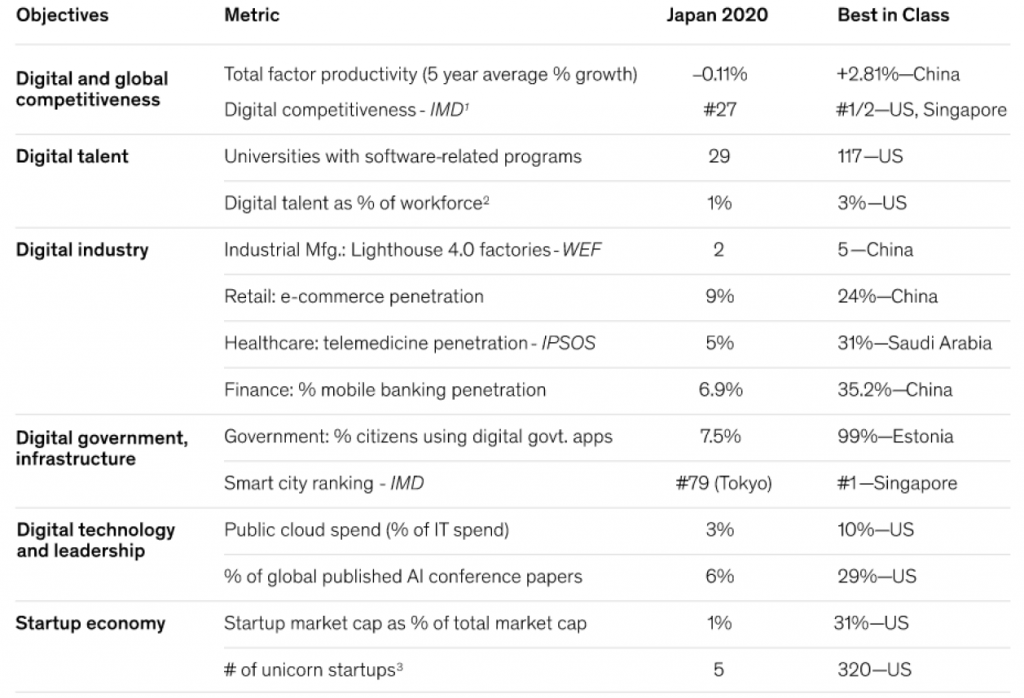

Figure 2: Employment conditions (all industries) – labour surplus or shortages (% points)