In this Thematic Insight we focus on ”substitution” – that is the opportunities firms have to substitute human capital for automation, digitalisation and, increasingly, artificial intelligence (see Definitions box) to help lower operating costs, increase productivity and/or to address talent and skills shortages.

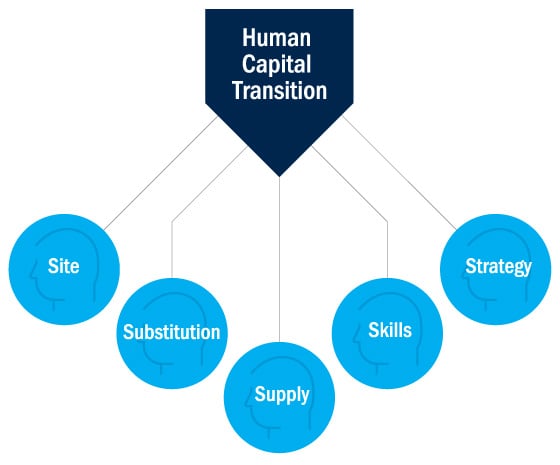

Figure 1: the Five ‘S’ framework of human capital

Source: Columbia Threadneedle Investments, 2023

Jobs lost, jobs gained, jobs changed

Just as the world of work was getting back on a more familiar footing following the seismic impact of the Covid-19 pandemic, along came the emergence of generative AI with the potential to further disrupt labour markets – including the companies in which Columbia Threadneedle invests.

The quantum of global jobs lost through firms substituting labour for new technologies, or indeed created by firms finding new ways of manufacturing goods and services, is unknown. What is apparent, however, is that a significant number of jobs done today will change.

History lesson

To maximise the opportunities AI and automation can provide, companies will not only need to invest in technology but manage their human capital effectively – reskilling and retraining existing employees, and promoting strong labour relations and supportive cultures. Alongside this they will need to attract new employees with distinct skillsets from their traditional hires.

AI sector opportunities and the implications for human capital management

Healthcare: supporting an ageing population and talent shortage

AI is already incorporated in healthcare products and services such as imaging and diagnostics, assisting with surgeries, drug development and supporting operational efficiency in hospitals. This is beneficial to a global health system under considerable pressure due to ageing populations and constraints to government spending. Wider adoption of AI (Figure 2) has the potential to reshape the sector by improving patient outcomes and driving efficiency gains. It is estimated it could lead to savings of 5%-10% in US healthcare spending (roughly $200 billion–$360 billion annually.15

However, talent shortages persist across the broad range of healthcare practitioners from healthcare assistants to biopharma lab technicians. According to LabioTech, in the biopharma sector alone there are in excess of 800,000 employees but more than 60,000 job vacancies, which indicates a labour shortage of approximately 8%.16 Projections show that job opportunities in the life, physical and social sciences sectors will grow by 7% by 2028.17 While AI may mitigate some of these shortages – virtual wards can support some aspects of remote healthcare provision – the role of labour within hospitals and within R&D will remain prominent. Shortages will need to be addressed for companies to meet their growth strategies.

Columbia Threadneedle will engage with healthcare companies in understanding their approaches to talent management and seek to understand how they are planning to manage the risks associated with AI within healthcare – for example, around data breaches.

Projections show that job opportunities in the life, physical and social sciences sectors will grow by 7% by 2028

Utilities: powering the future

Utility companies are vital to global economies, generating, transmitting and distributing the gas, electricity and water required to run businesses and households. However, the transformation required by these firms as the world shifts to a more sustainable energy system will be significant.

To support the transition to a net zero world, utility companies are looking to technology to improve efficiency, reduce costs and enhance service delivery. Drones can support defect detection and predictive maintenance in pipes, wiring or machinery; AI can enhance the consumer experience by offering dynamic lower prices when there is excess capacity; and generative AI could help tackle the challenge of integrating variable and unpredictable renewable assets into the energy generation mix through analysis of weather patterns and scenario analysis.

Columbia Threadneedle will continue to engage with firms which are key in decarbonising the energy system to better understand their talent management processes, as well as the opportunities they are exploring in new technologies to help the transition.

Catering companies: increased efficiencies and managing

recruitment challenges

Catering companies are labour intensive businesses. Last year, Compass reported that it recruited 110,000 individuals in North America alone.19 Labour as a percentage of revenue for the two largest catering companies in Europe, Sodexo and Compass Group, are around 47% and 49% respectively,20 while voluntary turnover of staff is high at 29%21 and 35%.22 Both companies are experiencing strong demand as firms look to outsource their culinary staff offerings to focus on their core business, which is putting further pressure on staffing demands in tight labour markets.

Catering companies are also using AI to leverage their data across their operations. AI technologies have allowed catering companies to better predict peaks in customer footfall, are used within CRM software to direct sales efforts towards the most valuable opportunities and help digitalise financial operations and administrative tasks. All of which have improved productivity and helped manage costs.

Going forward, generative AI may support sales teams communicate with potential clients and promote ways to upsell to existing clients. Generative AI may also help design the most efficient layouts of canteens and create pitch documents.

Columbia Threadneedle will continue to engage with catering companies to better understand the opportunities generative AI, automation and other technologies can offer to offset the risks inherent in a labour-intensive business. Likewise, we will explore the potential risks of generative AI on those sectors which use catering companies to provide food services, such as higher education settings.

Engagement case study: Relx25 – risk or revenue opportunity?

Background

The release in November 2022 of ChatGPT, a large language model owned by OpenAI and the fastest platform to a million users,26 raised market concerns regarding the possible impact of the technology on sectors most exposed to it.

Engagement

As part of our regular engagement with senior management teams, Columbia Threadneedle Investments met with European-based global business information services firm Relx. It provides information-based analytics and decision-making tools to help clients, such as those in insurance, legal or medical, to manage risks.

We wanted to understand how management saw the perceived risks and opportunities associated with generative AI, and how the company would ensure it has the appropriate human capital strategy, such as skilled labour, to deal with this transition.

Management outlined how their businesses have been using AI for more than a decade to support clients in analysing and making decisions. Insightfully, management believe it is not just access to the tech itself that gives the company a competitive edge, rather the proprietary data set and deep customer knowledge. As they put it, “the power is having all three”.

The CEO explained that while some of the data they use is publicly available, it has been collected over decades and often first hand (transcribing from within court houses) before being checked, stored and formatted in a searchable way in their own databases. This data is then overlayed with expert opinion and classified and mixed with proprietary data. The resulting database is, they conclude, fully proprietary. To replicate it would be extremely difficult, time-consuming and expensive.

Relx are not complacent, however, and are exploring ways they can improve their offering using generative AI. They have a product in trial that can respond to more conversational question searches, summarise cases and create draft client letters. They are also experimenting with numerous LLM models and see generative AI as an incremental positive for their long-term growth strategy rather than a significant threat.

In relation to human capital and attracting talent, Relx believe that the most important element of human capital is motivating staff through the “purpose” of the company – Relx products help their clients: they improve scientific study or medical outcomes, improve point of law and prevent fraud – this resonates with employees, and they are able to attract and retain good staff.

Conclusion

Columbia Threadneedle will continue to assess the impact of AI and other substitution opportunities on the growth strategies of the firms we invest in. Using the Five S framework we will also evaluate the associated implications for firms’ human capital management.

Definitions