What exactly is climate change risk?

Chris Wagstaff considers what climate change risk comprises through the lens of an institutional asset owner.

The sources of climate change are largely man-made. Principal among them is the burning of fossil fuels, though process emissions from activities such as manufacturing, agriculture and waste management contribute significantly to the world’s green house gas (GHG) emissions. Even the internet and its infrastructure generates as much CO2 as the entire airline industry.1 Combined, these activities continue to increase global temperatures, raise sea levels and perpetuate extreme weather, endangering livelihoods, health, habitats and economic activity.

Although climate change is a known unknown, most commentators agree that if left unchecked, its effects, as a global systemic risk, could be seismic. Indeed, a failure by all stakeholders to act more decisively on climate change could result in a deeply impaired economic and financial system. This would, in turn, severely inhibit the ability of asset managers to generate and asset owners to derive sustainable investment returns as well as expose asset owners to unacceptably high and largely unmanageable risks.

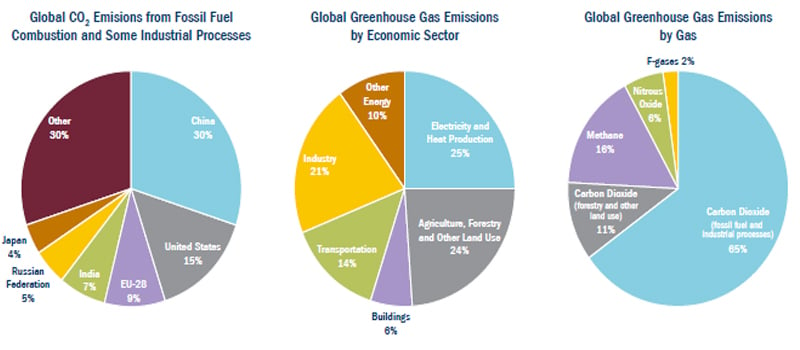

Figure 1 below sets out the UN Intergovernmental Panel on Climate Change’s (IPCC) breakdown of GHG emissions by country, economic sector and gas.

Source: IPCC (2014) based on global emissions in 2010. Contributions of Working Group III to the fifth assessment report of the IPCC.

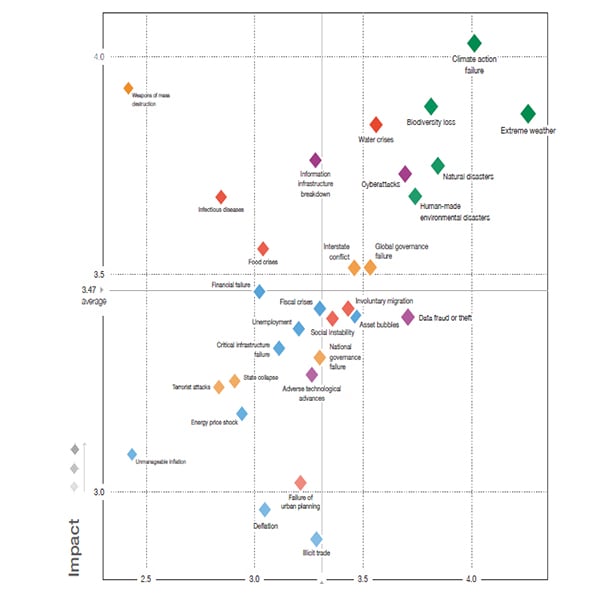

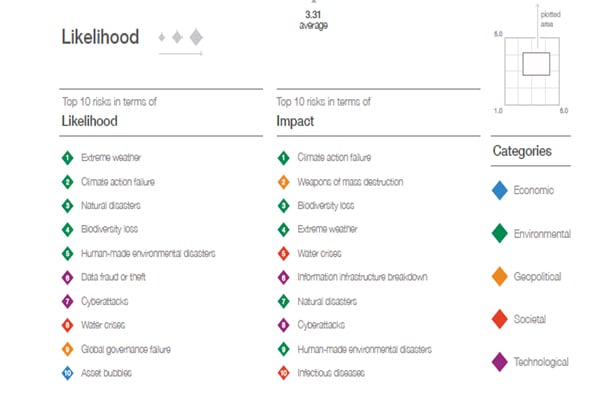

Given what has been discussed so far, perhaps unsurprisingly, environmental risks, climate action failure in particular, from both a likelihood and impact perspective, dominated this year’s annual World Economic Forum (WEF) Global Risks Report, for first time in its 15 year history. This is illustrated by the data points in the top right hand corner of Figure 2.

Figure 2: Environmental risks dominate the World Economic Forum’s Global Risks Report 2020

Source: Visual Capitalist, 17 January 2020.

Regulatory and reputational risk

While these visible risks are potentially tempered to varying degrees when policymakers, NGOs, regulators, consumers, pressure groups and fiduciaries (such as asset managers and asset owners) intervene to effect change, such actions introduce financial and economic risks. These are principally to those organisations that have been slow to adapt to the changing landscape or have resisted change.

These risks include regulatory risk (the risk of failing to anticipate regulatory change and subsequently being unable to comply with ever stringent environmental regulations), and reputational risk (the risk of being sidelined for failing to keep up with current thinking and developments). Of course, regulatory and reputational risk equally applies to those asset managers and asset owners who fail to move with the times, update their beliefs, and adapt their behaviours.

Transition and physical risk

Climate change risk – in an asset manager and asset owner context – additionally comprises the failure to sidestep and/or capitalise upon the transition risk and physical risk (outlined below) pertaining to the various asset classes, industries and individual securities across the globe. Additionally, for many asset owners this also extends to the transition and physical risks applying to their sponsoring organisation, especially to those asset owners heavily dependent on a strong sponsor covenant.

However, the regulatory initiatives currently applying to asset managers and asset owners approach climate change as a financial, rather than as an environmental, risk. That is, how climate change might impact the value of an investment, rather than requiring these institutional investors to set environmental targets to achieve positive environmental outcomes – targeting defined portfolio GHGs or a portfolio’s carbon intensity for example. This distinction is important as while this conflation may fall within many asset owners’ fiduciary duty, for others it may take them beyond what their fiduciary duty dictates and necessitate a normative judgement.

Transition risk

Turning to the risks themselves, the Prudential Regulation Authority (PRA) defines transition risk as that “arising from the process of adjustment towards a low-carbon economy”.2

Of course, transitioning to a low carbon economy, like any disruptive force, will invariably result in winners and losers. Therefore, the current carbon intensity of an industry or individual company, i.e. whether they are a high or low emitter, is secondary to whether that industry or individual company in question has the ability to transition to a low carbon world, via a chosen pathway, without being tripped up by myriad costly known unknowns along the way. This ability to sidestep, so-called, carbon lock-in is driven by the ability to negotiate a number of exogenous factors, such as current and prospective future regulation, legislation, carbon taxes, changes in consumer preferences and activist pressure, as well as how the capital expenditure budget is deployed and the substitutability of that capex.3

While some economic sectors will disappear, or experience higher costs of doing business, others with the foresight and the ability to reinvent themselves by transitioning to new low carbon technologies and/or offsetting their carbon emissions through carbon-capture technologies, stand to prosper, alongside those new entrants who emerge to tap into new areas of demand.

Crucially, transition risks are not confined to seemingly more obvious candidates. For instance, the consumer staples sector, comprising those non-cyclical companies which produce and sell those items typically considered essential for everyday use – food, beverages, household goods and hygiene products – faces considerable transition risks. By comparison, many energy companies have chosen transition pathways that not only continually manage to successfully sidestep carbon lock-in (evidenced by an adaptability improvement score that far surpasses that of any other industry) but also have redcued emissions by a greater quantum than any other.

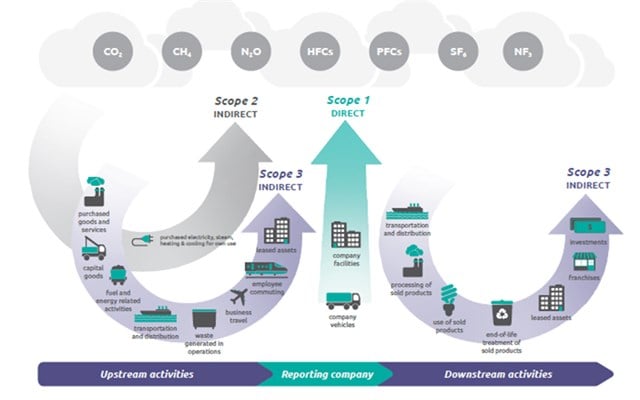

Although not an exact science, Figure 3 illustrates how an organisation’s EHG emissions are broken down into three categories, or scopes, in order to better understand their source and to address emission hotspots. Scope 1 and 2 emissions are those within the organisation’s control, while scope 3 emissions are not. Moreover, the latter typically comprise the greatest share of an organisation’s carbon footprint. Covering emissions associated with purchased goods and services, business travel, procurement, waste and water, often the environmental impact of a company’s supply chain is many times that of its own operations.

Figure 3: Scope 1, 2 and 3 emissions defined

Source: GHG Protocol, Compare Your Footprint. Scope 1 are All Direct Emissions from the activities of an organisation under its control. Scope 2 are Indirect Emissions from the production of the energy purchased and used by the organisation. Scope 3 comprises All Other Indirect Emissions that occur in a company’s value chain but outside their own operations.

Then there’s the potentially monumental declines in the physical asset values of those companies that fail to anticipate and adapt to regulatory, reputational and, particularly, transition risks in the move to a low carbon economy – or those unable to reinvent themselves. In extremis, many assets will be rendered uneconomic and, in popular parlance, become stranded. For instance, if policymakers were to align with limiting the post-industrial increase in global temperatures to 1.5°C, then a whopping 84% of remaining fossil fuels would need to be left in the ground resulting in a plethora of coal, oil and gas assets becoming stranded.4

Physical risk

Secondly, there are the physical risks of climate change – those risks to life and property resulting directly from the effects of global warming already discussed. According to the PRA the “physical risks from climate change arise from a number of factors, and relate to specific weather events, such as heatwaves, floods, wildfires and storms and longer-term shifts in the climate…”5Although one particular group of asset owners, insurers, are particularly susceptible to physical risks, given the liabilities they assume, other asset owners, not least defined benefit pension schemes, are far from being immune.

Be on the front foot

Given the above, it isn’t inconceivable that almost all asset owners will soon be required to integrate climate change scenarios within their investment decision making and risk management. Indeed, insurers are already compelled to develop climate change risk management practices and have a climate change risk management policy in place.6

Therefore, now is the time for those asset owners who have yet to do so, to start thinking about how they might best approach climate change risk management by adopting a number of non-mutually exclusive mitigating actions to address transition and physical risks.

In our next two articles we look at these mitigating actions, the practicalities of each and how effective they may be, alongside the principal considerations in approaching, and the obstacles to be overcome in implementing, an effective climate change risk management policy.