The old adage “money makes the world go round” has never rung so true. In the investment world, money translates into corporate earnings and cash flows, which analysts have used for years to value companies.

But what happens when this “money” dries up? That is essentially what we have seen in the past few weeks – firms across the world, both big and small, have seen a liquidity crunch as spending by consumers and businesses has essentially ground to a sudden halt. Add to that the difficulty in predicting how countries will continue to be affected by and recover from Covid-19, and we have the ingredients for forecasting uncertainty. Valuing companies just became a whole lot harder.

In the absence of a clear trajectory around corporate cash flows and earnings, with many companies themselves withdrawing future guidance, using some of the more conventional valuation techniques such as price-to-earnings is challenging given the unknown denominator. So, during recent bouts of market volatility, we have found book value analysis a helpful tool in the equity valuation toolkit, given that it tends to be more static in nature.

Book value analysis essentially seeks to determine the realisable value of a company’s assets in the event of liquidation, ie, what is left for equity holders according to the company’s balance sheet. A 1x price-to-book value would imply that the market is only willing to pay the equivalent of book value for a company, or in other words does not believe that the company can deliver significant positive growth from its assets.

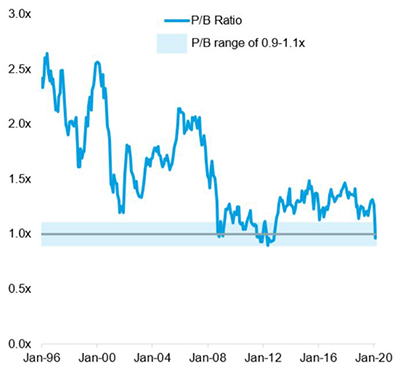

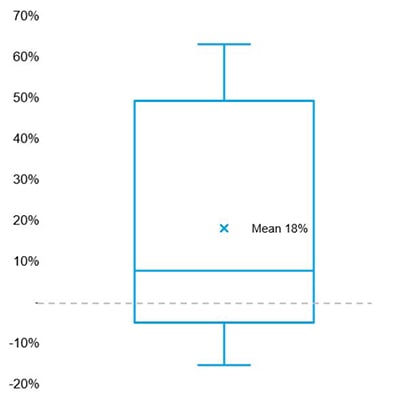

We applied this valuation lens to equity markets in early March, seeking to determine levels at which different regions would reach attractive enough levels for us to deploy our risk budget. As markets tracked downwards, Japan increasingly stood out with prices falling through 1x book values in mid-March – very close to the lows of the past 20 or more years (Figure 1). History tells us that prospective 12-month returns from these levels are asymmetric to the upside (Figure 2), hence we added to our Japanese equity exposure.

Figure 1: Price to book for TOPIX fell below 1x

Figure 2: Distribution of subsequent

1-year returns from a P/B starting

point of 0.9-1.1x

Source for both charts: Columbia Threadneedle and Bloomberg, 31 March 2020.

However, with decade-high volatility, key valuation levels are being triggered more frequently and, with the fast-moving economic and human response to Covid-19, fundamentals are changing quickly too.

Japan’s outperformance

In the case of Japan, the equity market managed to outperform global equities by a stellar 13% over the second half of March, making relative valuations less attractive within a short space of time. Although still supported by the long-term structural improvement story of better corporate governance, Japan is a strongly cyclical and operationally leveraged market that is highly exposed to “sudden stops” in global activity; room for stimulus is also judged to be more constrained than elsewhere. And, unlike other regions, savage falls in earnings expectations had yet to come as of a week ago – unrealistic by our judgment.

In keeping with our investment process, where either changing valuations and/or fundamentals can prompt a change in view, we have downgraded Japan to a neutral from favour, reflecting those fuller relative valuations and softer fundamentals in the current global setting. Although we retain an overall preference for equities (alongside higher-grade credit), today it feels prudent to concentrate risk in less cyclical areas better placed to weather the storm.

In these abnormal times, money does not make the world go round – healthcare workers do. But markets remain open and dislocations will continue to emerge as the markets attempt to price the effects of this unprecedented and sudden stop to the normal flow of money.