Per-and polyfluoroalkyl substances (PFAS), or “forever chemicals” as they are more commonly known, are increasingly grabbing headlines

- With the prevalence of per-and polyfluoroalkyl substances (PFAS) growing – in humans, animals, the environment and products and manufacturing processes – thresholds for exposure levels and water quality are declining. PFAS are presenting risks and opportunities for companies across the value chain

- As concerns about pollution rise, further regulations are being brought in. The US is focusing on clean-up, while Europe is aiming to phase-out PFAS

- What can investors do to effectively engage with companies to understand their exposure to PFAS and encourage responsible stewardship?

As environmental testing for these compounds becomes more widespread, they are being found nearly everywhere we look. Their widespread presence, along with their resistance to degradation and their mobility once in the environment, means PFAS can be found in most humans and wildlife across the globe1.

A growing number of PFAS compounds are the focus of epidemiological and animal studies, which show associations with negative health impacts including endocrine disruption, liver damage, increased cholesterol, higher risk of certain cancers, thyroid issues, reduced birth weights and lower response to vaccines.

The term PFAS refers to a class of thousands of synthetic chemicals, the common denominator being extremely strong carbon-fluorine bonds. “Long-chain” PFAS, such as perfluorooctanoic acid (PFOA) and perfluorooctanesulfonic acid (PFOS), are legacy compounds now included in the Stockholm Convention on persistent organic pollutants, while “short-chain” PFAS were created more recently as replacements for long-chain PFAS and include fluoropolymers, a widely used group of substances. Most short-chain compounds are thought to have a lower tendency to bioaccumulate in humans; however, they are highly mobile in the environment, where they can also react to form other PFAS.

PFAS are ubiquitous across the natural world as a result of their use in any number of products and manufacturing processes that comprise the global economy (Figure 1), from semiconductors, solar panels and hydraulic systems in aircraft to medical equipment, PPE and food packaging and textiles. At each stage of product manufacturing, use and eventual disposal, PFAS are released to surrounding water and soils, with major sources including industrial sites, landfills and wastewater treatment facilities.

Figure 1: EU PFAS demand in 2020 by end use (mid-range estimates)

Source: Columbia Threadneedle Investments/European Chemicals Agency, 2023

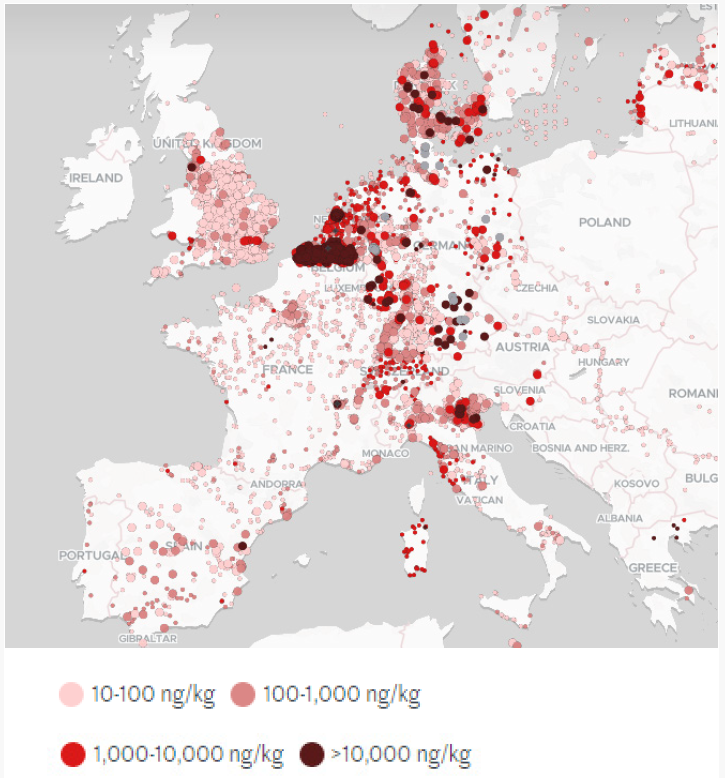

Data across the US and the EU, tracked by the Environmental Working Group and Watershed Investigations, shows just how widely PFAS are found. To put Figure 2 in perspective, the dots on the map are watersheds where PFAS compounds were more than 10 parts per trillion in 2022. Although this sounds miniscule, the US Environmental Protection Agency (EPA) has proposed a drinking water standard of just four parts per trillion.

Figure 2: presence of PFAS

Source: Le Monde, Watershed Investigations, 2023

As PFAS are turning up in more places, increased health research, concerns about the risk of exposure for infants, children and during pregnancy, and increased awareness have seen the introduction of lower regulatory thresholds for exposure via drinking water (Figure 3).

Figure 3: allowable levels of PFOS and PFOA in drinking water (parts per trillion)

*EU threshold is for sum of 20 PFAS

Source: Columbia Threadneedle Investments/US Environmental Protection Agency 2023; UK Drinking Water Inspectorate 2021; European Commission 2020

Dual regulatory approaches emerge

In the US, an increasing range of regulations at state and federal level are driving pollution clean-up. Key developments to watch over the second half of 2023 are the anticipated designation of PFOS, PFOA and potentially other PFAS as hazardous under the CERCLA (Comprehensive Environmental Response, Compensation, and Liability Act) regulations, triggering remediation requirements under the CERCLA Superfund programme, and the US Environmental Protection Agency’s finalisation of proposed thresholds for drinking water standards2.

As these regulations are introduced, many more areas of contamination will be found, which will drive further clean-up costs around soil remediation as well as for water and wastewater filtration and treatment. Many municipalities are already seeking to recoup costs through litigation3, a trend that is set to expand as the scale of clean-up costs is better understood.

In contrast to the focus on clean-up in the US, Europe is seeking to phase out the entire class of PFAS compounds. The European Chemicals Agency (ECHA) is consulting on a proposed two-year timescale, with a handful of specific applications such as medical devices or semiconductor manufacturing receiving exemptions for up to 14 years4. The rationale for the phase-out is concern around the persistence of PFAS compounds, given the incredibly long timeline required for research on harms resulting from individual substances. The ECHA also aims to prevent “regrettable substitution”, where known harmful PFAS compounds are replaced by other PFAS that may ultimately be determined to be just as harmful.

It is also the ECHA’s view that water filtration is both expensive and not entirely effective, leading to a preference for avoiding pollution at source. While phase-out may prove less costly than continual clean-up, the impacts are likely to be significant. Discussions we have had with companies have highlighted the lack of suitable alternatives for some applications, and the challenge in undertaking research and development (R&D) on relatively short timescales, given the wide-scale use of PFAS compounds.

It should be noted that some US states are also pursuing bans and phase-outs that, although narrower in scope, are along the lines of the ECHA proposal. This leads to the potential for fragmented regulatory frameworks, with companies required to adapt across different markets.

No easy solutions

Unfortunately, remediating PFAS is not necessarily easy nor cheap. For drinking water, filtration technologies including granular activated carbon, ion exchange resins and reverse osmosis or nanofiltration are generally effective, but they all entail tradeoffs including space and engineering requirements as well as suitability for different types of PFAS. Perhaps most importantly, each technique generates PFAS-contaminated waste – either spent carbon or resins, or residual filtered water. Each must then be managed appropriately, adding further costs.

Eventually, emerging technologies may facilitate cheaper and easier PFAS removal, potentially destroying PFAS at industrial, landfill or wastewater sites, reducing the need for downstream filtration or offsite hazardous waste management. Technologies such as supercritical or electrochemical oxidation are in development on this front but are not yet at a commercial stage. Moreover, once again they are not without trade-offs, particularly regarding energy use.

Until technologies develop, waste and hazardous waste companies will be best positioned to fulfil the anticipated growth in PFAS waste management. Deep-well injection, controlled landfills or, potentially, specialist incineration may all have a role to play.

Engagement

The rapidly changing regulatory context presents risks and opportunities for companies across the whole of the value chain – from PFAS production to use in manufacturing and products and ultimately disposal. Understanding the potential risks and opportunities is not necessarily straightforward. As investors this provides us with opportunities to engage with companies to better understand their exposure to PFAS, and to encourage responsible stewardship of PFAS where used in products and manufacturing. Engagement can focus on five key aspects:

- Presence: does the company understand where PFAS are used in their products and manufacturing?

- Regulatory awareness: is the company prepared for the implications of regulations such as phase-outs?

- Phase-out plans: are non-essential uses being phased out? What scale of R&D will be required?

- Liability risks: are these understood and mitigated to the extent possible?

- Pollution controls: where PFAS are used, are emissions fully captured? What level of capex is required?

- Upstream: do suppliers have robust pollution controls where PFAS or fluoropolymers are manufactured?

- Downstream: does the company work with customers to ensure materials containing PFAS don’t enter the environment?

Investor tools

Our research on this topic highlighted not only the need for engagement but the lack of relevant disclosure among companies, making it challenging for investors to understand their own exposure to this issue. Tools such as ChemScore, a comparative assessment from NGO ChemSec of large chemical producers based on their production, management and transparency on hazardous and persistent chemicals, can play a key role. The most recent iteration of the ChemScore report included 54 chemicals companies and found the industry is making little progress; nearly half of those businesses assessed performed worse than in the prior year.

In an open letter in September 2022, a group of 47 investors, including Columbia Threadneedle Investments, called on chemical companies to be more transparent regarding their hazardous chemical portfolios, to publish a phase-out plan for persistent chemical production, and to work on improving their scores within the ChemScore framework. We will continue to monitor the industry and its firms to see how it adapts going forward.

Engagement case study

Company: Waste Connections7

Sector and country: Industrials, US

Why we engaged

As landfill leachate can be a source of PFAS pollution, we wanted to better understand the implications of forthcoming PFAS regulations for the waste sector and the related risks and opportunities for companies.

What we learnt

Waste Connections has taken a proactive response to understanding and mitigating PFAS risks, with a sustainability target to process 50% of landfill leachate on site, up from the current 37%. On-site processing reduces the potential for downstream pollution and, as regulations tighten, can also reduce costs for transport and leachate treatment at specialised wastewater facilities. In addition to investing capex in wastewater treatment facilities, the company is also investing in leachate research to identify lower-cost methods to remove PFAS from leachate.

The theme presents opportunities as well as risks. As regulations tighten, volumes of waste are likely to increase – for instance, sludge currently spread to land as fertiliser may require landfilling in the future due to reduce PFAS contamination of agricultural lands.

What was the outcome?

We identified Waste Connections as a relative leader on the PFAS theme among the waste sector, being relatively well positioned to navigate the changing regulatory landscape.