For decades banks have benefited from a customer inertia that has provided a cheap and stable source of funding and a high margin payments revenue stream. But these are now at risk from FinTech entrants trying to establish themselves as platform providers for payments, deposit accounts and other banking services. A recent McKinsey study, for example, estimates that payments account for around 30% of global banking revenue1, and this is where the digital Payment Service Providers (PSPs) are moving in.

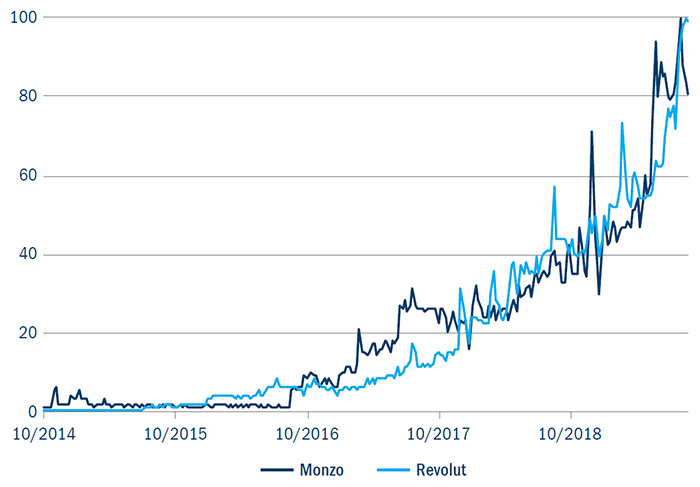

Adoption will take time, but there is growing interest (Figure 1). Digital banks such as Revolut and Monzo offer savings on overseas spending and transfers where the customer enjoys the cheaper interbank exchange rate rather than the exchange rates offered by traditional providers.

Figure 1: Global Google Trends search data for Monzo and Revolut 2014-2019

Source: Google data. Numbers represent search interest relative to the highest point on the chart. A value of 100 is peak popularity, a value of 50 means the term is half as popular. Zero means there was not enough data for this term.

The real risk, however, is one of the larger tech organisations entering the space, with brand power and a treasure trove of behavioural data.

Where can you bank on dividends?

While banks don’t have stellar reputations, they do have established brands and are trusted as safeguards of customers’ money and data, giving them an opportunity to reposition their business models. In addition, the proliferation of FinTech competitors chasing the same customers has led some to partner with established banks which have the large customer bases that the entrants covet.

Generally, we focus on larger banks as they have sufficient scale to shoulder the increasing regulatory burden and rising IT costs. Those with the best digital offerings will over time take high value customer market share from peers, and smaller banks will waste away. A behavioural shift is also required that puts the customer at the centre of the proposition, rather than relying on inertia.

Countries such as the US and Singapore offer solid asset growth in developed markets without undue pricing pressure. Indonesia and Brazil, meanwhile, have some of the most attractive high dividend yield bank stocks within emerging markets, offering appealing nominal growth and attractive market structures. China, however, faces some difficult challenges as it looks to liberalise the financial system and big tech enters the more profitable areas.

We also steer clear of low growth countries with fragmented markets and unhelpful regulation. Europe stands out here, as on top of the cyclical issues it faces far higher structural challenges due to the 2018 Open Banking regime. That said, we find relatively attractive pockets in northern Europe with consolidated industry structures and sophisticated digital offerings. Japan remains challenged, where the cyclical appears to have become structural.

Big dividends but a need to tread carefully

Bank stocks have struggled over the past decade, and structural challenges could strip away the profitable parts of the industry. Income investing is about avoiding the land mines, so it is imperative to focus on the safer neighbourhoods and players with the best digital offerings in order to find “quality income” bank stocks that offer high, sustainable and growing dividend streams.

Read the full version of this income investing analysis