The reopening of economies over the third quarter, along with ongoing government fiscal support and sustained low global interest rates which help support stock valuations, continued to boost markets after the March sell-off, moving them into positive territory for the year.

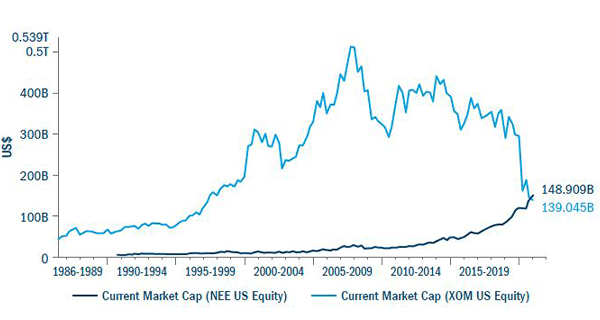

Against this backdrop, the Global Sustainable Outcomes strategy enjoyed a strong quarter, rising 12.6% and outperforming the MSCI ACWI index by 4%.1 Those companies whose products and services support global decarbonisation were among our top-performing stocks over the quarter. These include our holdings in renewable energy leaders Nextera Energy and Orsted, as well as the electric vehicle battery maker Samsung SDI and the building insulation company Kingspan whose solutions help make buildings more energy efficient.2 In fact, with the oil sector continuing its downtrend over the quarter, the market capitalisation of Nextera (which could be defined as “new energy”) now exceeds that of Exxon Mobil (“old energy”) for the first time in history (Figure 1). These “new energy” companies have been buoyed by governments around the world making positive environmental policy changes and introducing carbon neutrality targets:

Figure 1: Nextera market cap exceeds Exxon Mobil

Source: Bloomberg, October 2020.

- The European Parliament voted in favour of raising its 2030 greenhouse gas emission reduction target from -40% to -60% compared to 1990 levels. It is also introducing fiscal stimulus to drive investment towards green technologies through its post- Covid-19 recovery fund.3

- The UK government has committed to raising its 2030 offshore wind target, with prime minister, Boris Johnson, pledging to boost UK offshore wind power as part of a “Green industrial revolution”.4

- Both Japan and South Korea introduced new targets for net zero emissions by 2050, a key part of which will be replacing coal power with renewable energy.5

But it was China which surprised markets by announcing a pledge to become carbon-neutral by 2060 during a UN meeting, with an aim to embed this goal into its next five-year plan. It is also seeking to see peak carbon emissions “before 2030”.6 This is the first time China has set a concrete long-term target of carbon neutrality and will be transformational for international efforts to limit climate change given the country accounts for around 27% of the world’s greenhouse gas emissions.7 In fact, the Climate Action Tracker, an independent scientific analysis that tracks government climate action and measures it against the globally agreed Paris Agreement, estimates that if China meets this target for carbon neutrality it will help lower global warming projections by around 0.2-0.3 degrees Celsius and help put the world a step closer to achieving the Paris Climate Agreement’s goal of net zero emissions by 2050.8

Even at the micro level, corporates continue to announce climate-neutral targets and direct investment towards transitioning away from fossil fuels. Global energy companies have notably stepped up on their commitments to allocating capital towards green energy, while auto OEMs (Original Equipment Manufacturers) have accelerated their electric vehicle targets and launched new models. Even large financial services companies are making changes, with JP Morgan promising to shift its financing portfolios away from fossil fuels.9 Meanwhile, the consumer goods giant Unilever, one of our strategy holdings, set a target in June to cut all carbon emissions from its operations and suppliers by 2039.10 It then announced in September a €1 billion ($1.2 billion) investment to help its suppliers adopt technologies to eliminate the use of fossil fuels in the production of cleaning products by 2030, ie to replace oil in the production process.11 Another holding, Croda, went a step further by highlighting during its sustainability investor day its 2030 target to be “climate, land and people” positive.12 By developing innovative product solutions it aims to enable more carbon to be saved than it emits, and more land to be saved than used to grow its bio-based materials. A key aim of the Global Sustainable Outcomes strategy is to invest in those companies that contribute positively to our theme of energy and climate transition, thus helping to support both governments and companies achieve their carbon-neutral targets and help combat climate change.

Sustainable theme focus: Covid-19 highlights the importance of health and wellbeing

At the beginning of lockdown my husband attempted to buy a new bicycle, writes Pauline Grange. He finally got one after being on a waiting list for six months as demand for bikes rocketed during the pandemic. Suddenly, increasing numbers of people were cycling and jogging in our local park in order to improve both their physical and mental wellbeing during the stresses of lockdown.

With reports linking the severity of Covid-19 with obesity, it is no surprise that many people are looking to stay healthy. These reports have not just spurred individuals into action, but are also likely to spur governments on to adopt more proactive strategies to combat obesity and reduce the incidence of risk factors for noncommunicable diseases (NCDs) such as diabetes. These NCDs are not only linked to worse Covid-19 outcomes but are also an increasing burden on government health systems. In fact, our knowledge of health systems has grown significantly over the past decade. A study published in the Lancet in June 201813 revealed that, unsurprisingly, there is a strong positive correlation between population health and health spend per capita. However, there are many notable exceptions. For example, Finland, which ranks sixth in terms of access to and quality of healthcare, and Italy (ninth) both spend less on healthcare per capita than the UK (23rd) but rank higher, while the US has the highest healthcare spend per capita in the world yet ranks only 29th.

These anomalies in some of the richest countries can be explained by cultural differences. More than 70% of Americans are overweight or obese,14 and the prevalence of severe obesity has increased over the past two decades. The UK is very similar with 67% of men and 60% of women considered to be overweight.15 These high rates of obesity are a key public health problem and also a key driver for diet-related chronic diseases, such as cardiovascular disease, type 2 diabetes and some types of cancer. At present, six in 10 Americans have a chronic condition and four in 10 have two or more chronic conditions.16 Various factors contribute to the prevalence of these chronic diseases, but prominent among them are unhealthy dietary patterns and a lack of physical activity. In the UK it is now widely acknowledged that our higher levels of obesity are a contributing factor to the country having the highest Covid-19 mortality rate in Europe. As governments wise up to the fact that cultural and lifestyle factors are more than offsetting any incremental gains from additional per capita healthcare spend, we can expect to see policy shifting to target these areas, particularly during the current crisis. Food is one of the easier avenues for governments to influence public health and the incidence of obesity. Over time, less healthy foods and beverages are likely to be subject to increasing restrictions on advertising, sugar taxes and increased product labelling warnings. These measures may be more likely in countries with higher incidences of diabetes, worse outcomes from Covid-19, and more extensive public health systems.

In July Boris Johnson adopted a more proactive stance on obesity after contracting Covid-19 himself. New measures proposed5 include: a ban on TV and online adverts for foods high in fat, sugar and salt before 9pm; ending deals such as “buy one get one free” on unhealthy foods high in salt, sugar and fat; calories to be displayed on menus to help people make healthier choices when eating out; and the requirement for alcoholic drinks to list hidden “liquid calories”. Finally, a campaign is being launched to help people lose weight, get active and eat better. A more active lifestyle is also a key tool in combatting the global obesity crisis. The World Health Organisation states that insufficient physical activity is one of the leading risk factors for mortality worldwide. Government campaigns to help people lose weight and get active are likely to be important in reversing these trends. Activewear companies such as Adidas (a holding in our strategy) also serve to promote this healthier lifestyle through their marketing and community support campaigns, while benefiting financially from the consumer shift towards a healthier lifestyle. The Global Sustainable Outcomes strategy actively avoids companies whose products and services contribute towards the obesity and health crisis, such as alcohol and fast-food companies, while prioritising those consumer companies whose products contribute towards a healthier diet and lifestyle. If government policies prove successful, we believe companies with a better health profile should benefit while those with less healthy portfolios will face increased costs and challenges in the future.

Company Q2 2020 sustainable impact highlights