The coronavirus is a social issue that has brought unprecedented disruption to societies and is impacting the wellbeing of the world’s population. Capital markets are responding to this challenge with more than $9 billion of social bonds issued in the past three weeks, all from supranational entities. However, more can be done, and this presents a great opportunity for governments to follow suit.

When considering environmental, social and governance (ESG) investments, social attributes are often overlooked for the more salient environmental and governance characteristics. A contributory factor for this can stem from environmental and governance aspects of a company being easier to assess, ie, we can measure carbon emissions from aircraft or board diversity relatively easily. Social has been a bit more challenging in that regard. For example, job creation is important and paramount to invigorating an economy, but we need to understand the quality of jobs being provided in terms of how workers are treated and compensated. However, we may be entering a period where social investing comes to the fore.

Gauging investor interest

The bond markets have traditionally been a great barometer of investor interest in ESG-related activities through the issuance of green, social and sustainability bonds. These are defined as “specific use-of-proceeds” bonds, which means the financing is exclusively channelled to pre-identified projects where the outcome will be green, social or sustainable (a mixture of green and social). This area has grown rapidly in recent years, with the amount of issuance nudging over $800 million (Figure 1).

Unsurprisingly, green bonds have dominated this landscape, ie issuers have focused on bonds where the use of capital is directed towards environmental projects. Social issues amount to more than $56 billion, catalysed by the International Capital Market Association (ICMA), to support the financing of projects aimed at addressing the Covid-19 threat.

Figure 1: Green, social and sustainability bond issuance (as at 2 April 2020)

$ Billions | Green | Sustainability | Social | Total |

|---|---|---|---|---|

2019 issuance | 220.6 | 47.7 | 17.3 | 285.5 |

2020 YTD issuance | 42.2 | 15.3 | 12.0 | 68.5 |

Amount outstanding | 649.5 | 97.6 | 56.7 | 801.8 |

Source: Bloomberg and CTI, 2 April 2020

In fact, the supranational community is already allocating capital to tackle Covid-19 with more than $9 billion of debt issued in the past three weeks1, through the IFC Social Bond; the IADB Sustainability Bond; the African Development Bank Social Bond; the Nordic Investment Bank Response Bond; and the two most recent, the European Investment Bank and the Council of Europe Development Bank, which were both €1 billion issues and were 5.9 and 3.9 times oversubscribed respectively. In aggregate, these bonds will support products and services contributing to health conditions and maintaining living standards for communities impacted by the Covid-19 virus.

These issues fall within the ICMA Green and Social Bond Principles and target healthcare, access to finance for small businesses, employment and longer-term green infrastructure projects among other specific use-of-proceeds (Figure 2).

Figure 2: Covid-19 specific use-of-proceeds issuance as at 2 April 2020

Issuer | Type of bond | Use of proceeds |

|---|---|---|

African Development Bank | Social | Proceeds will be allocated in line with the AFDB’s Social Bond program, to provide support and financing to countries and businesses fightingCovid-19. |

Inter-American Development Bank | Sustainability | The IADB is offering up to $2 billion in resources for countries requesting support for disease monitoring, testing and public health services, as part of its coordinated efforts to fight the Covid-19 outbreak. |

IFC | Social | The World Bank Group, of which IFC is a constituent, will help developing countries strengthen health systems, including better access to services to safeguard people from the epidemic, strengthen disease surveillance, bolster public health interventions, and work with the private sector to reduce the impact on economies. |

Nordic Investment Bank | Covid-19 response bond | Loans will support the provision of products and services contributing to health conditions and maintaining living standard for groups challenged by Covid-19. More specifically, they will target the financing of impacted small and medium-sized enterprises and the financing of large companies in the medical equipment and healthcare sector facing increased demand for equipment or services. |

Council of Europe Development Bank | Social | Support for health infrastructure to cover the acquisition, under emergency procedures, of medical equipment and consumable material; the rehabilitation and transformation of spaces, medical units; and the mobilisation of additional expertise. Also, support for SMEs and municipal companies with a focus on the preservation of jobs and on enabling ongoing municipal investments. |

European Investment Bank | Sustainability | Lending to health projects substantially contributing to universal access to affordable health services (SDG 3). SAB-eligibilities are being extended to additional areas of the EIB’s financing directly related to the fight against Covid-19, in line with a national/international health emergency response or preparedness plan. These include support to national health authorities, hospitals, laboratory facilities and networks. |

Source: Issuers New Deal Presentations, 2020

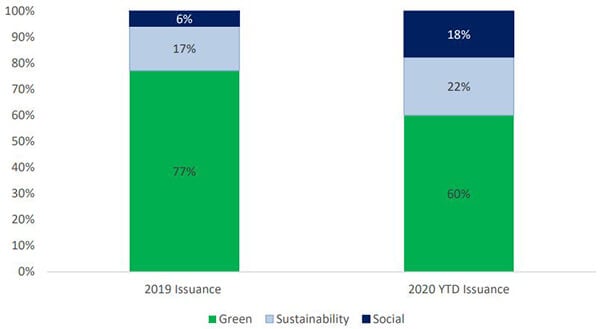

The current crisis, however, has added impetus to widen the scope from green bonds to social and sustainability bonds as well. For example, IFC has been issuing social bonds since 2017 raising $1.46 billion across 28 bonds as at 31 December 20192. Its latest social bond is a $1 billion issue, thus almost doubling its social bond book in one fell swoop. This trend is broadly reflected when we look at the global issuance of specific use-of-proceeds bonds. Social represents 18% of these year-to-date, which is an unprecedented proportion, and it is thought that this trend will continue as we move through and out of the pandemic (Figure 3).

Figure 3: Allocation of green, sustainability issuance in 2019 and year-to-date 2020

Source: Bloomberg, 2 April 2020

Psychologically, investors are typically monothematic, ie we can only concentrate on one big idea at a time. Previously this was climate change, and while it is still, of course, of paramount importance, it is taking a back seat as investors focus on the immediate Covid-19 crisis. We predict there will be greater issuance in social bonds to tackle this health crisis, but post-Covid-19 climate change will likely resume its role as the key ESG theme, although social will remain prominent in people’s minds.

A sweet spot for government issuance

This presents an opportunity for governments to follow in the footsteps of the supranationals and issue sovereign bonds in response to this crisis. Sovereigns issuing specific use-of-proceeds bonds is not a new idea: a number of countries have done so in the past three years, including the Netherlands, France, Ireland and Belgium (all of which were green bonds).

An interesting pattern from the sovereign issues is that UK investors are consistently one of the largest purchasers. For example, with the recent Council of Europe Social Bond they represented 14% of purchasers (behind only France at 25% and Asia at 16%)3. However, despite the investor appetite the UK has yet to issue a gilt of this nature. Our view is that the current crisis has created a sweet spot for a social Gilt which not only supports the immediate crisis but tackles longer-term social challenges.

Environment or social?

An interesting question will arise if we start to see evidence of social characteristics superseding environmental aspects when considering investments. Air travel and shipping are two areas where the social aspects are often overlooked due to the negative environmental aspects (carbon emissions of the transportation), but aviation and shipping are inherently highly social. Our Sustainable Infrastructure fund recently invested in a ferry operator which serves freight and passenger services from mainland UK and France to the Channel Islands. A key consideration for the investment was social because the asset provides vital freight to the islands. There are currently no passenger services on the route due to the coronavirus pandemic, but the ferry continues to provide vital food and medical supplies to the Channel Islands.

Similarly, we are starting to see companies focus on the social side of business in the fight against Covid-19. The crisis is placing a spotlight on a firm’s social policies towards key stakeholders including employees, suppliers and customers. Examples of this include the likes of Uber and Lyft partnering with hospitals, local governments and non-profits to fund free rides for key workers – from grocery store staff working additional late-night shifts to food bank customers coming from areas with food insecurity.

In conclusion, Covid-19 has heralded unprecedented times for communities across the world. The delivery of social bonds to alleviate this pandemic is welcome, but further issuance is required and is an invitation for governments to step-up and structure social bonds. We expect to see further behavioural shifts from corporates towards social outcomes when we exit this crisis and believe social investing is here to stay.