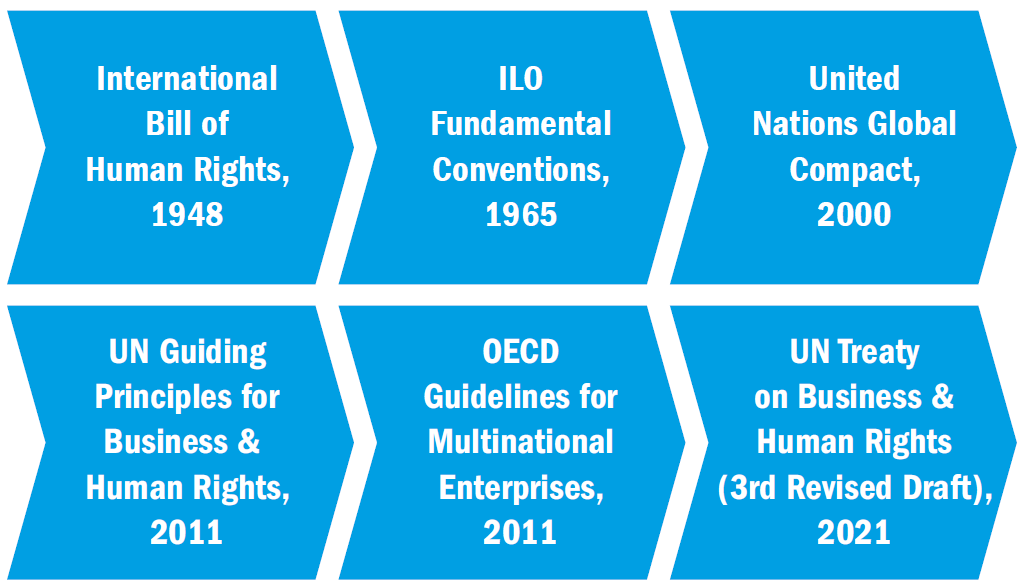

Figure 1: A history of human rights

Vigilant active management

The NCP mediation process between Teleperformance and UNI resulted in a Final Statement on 5 July 2021, summarised in the following excerpt:1 “The NCP notes that, following an emergency management phase, Teleperformance has deployed and continues to implement a policy to prevent, manage and monitor the pandemic in all its subsidiaries in order to address health risks associated with the pandemic. This policy broadly corresponds to the expectations of corporate due diligence recommended by the OECD Guidelines.”

A second case concerns Nestlé, one of the world’s largest food and beverage brands. Rather than pursuing OECD mediation, complainants alleged human rights abuses by Nestlé, as well as other firms, using the US ATS. The lawsuit was dismissed in June 2021 as the ATS could not be applied extraterritorially. However, it highlighted the problem of child labour and forced labour across global commodity supply chains. While already aware of Nestlé’s progress in this area, the case prompted us to review its HRDD policies and practices. We held a call with the Head of its Cocoa Plan, the supply chain in which the abuses were alleged.

Nestlé sources 46% of its cocoa sustainably through the Cocoa Plan, and has an ambitious 100% target for 2025.3 Progress towards this goal was key when we decided to invest for the Pan European Sustainable Outcomes strategy. Nestlé’s integration of human rights into its policies and practices is shown through a variety of ongoing initiatives aimed at systemic change. For example, it is helping children re-enter education, pooling labour to avoid their employment, raising household earnings through incomegenerating activities for women and agricultural training to boost yields by up to 4x. While some, including ESG ratings agencies, penalise Nestlé for the presence of child labour, we praise its transparency and ongoing efforts to address it. Controversy still exists, but tangible mitigating action is evident.