Key Takeaways

- The speed of electric vehicle adoption is varying by region. China is leading the way with rapid growth. Europe is picking up pace with sales up 30% in 2025 relative to 2024, but the US is lagging.

- High prices have hampered growth, but advances in battery technology and production efficiency gains mean costs are expected to decrease by 20% by 2027. Near-parity with combustion engine vehicles is on the horizon.

- In China and Europe there is strong policy support for electric vehicles – China has extended its $11bn cash-for-clunkers scheme. There is less impetus in the US from a policy perspective.

- Chinese automakers are well placed to capture market share – a function of their technological and cost advantages. We are looking to tap into related opportunities in select portfolios.

Early market optimism on the electric vehicle (EV) transition has faded over the last two years as growth rates in Europe and the US have stalled. Today we can see a three-speed global EV market: China is surging ahead, Europe is showing renewed momentum, and the US is stuck in the slow lane. Over the last few months, we have conducted a research project to appraise the factors that we see dictating the pace of the EV transition: the ability of technology developments to reduce upfront EV costs, the degree of policy support by market, how Chinese competition will influence the market, and the pace of EV charger deployment. Our research indicates that while significant barriers to EV adoption persist, the industry is approaching several critical inflection points that could accelerate the transition to electric mobility.

EV adoption: full speed ahead in China, Europe shifts gears, US idles

The global EV landscape shows distinct regional patterns, with China leading the charge, Europe following and the US slower to adopt. In 2023 and 2024 EV adoption in Europe and the US flatlined. However, Europe has shown strong momentum in early 2025, with EV sales up 30% compared to the previous year. This trajectory suggests European EV penetration could reach 19-20% by year-end, driven by the introduction of more affordable options in previously untapped market segments. The US market presents a more challenging picture, with EV penetration expected to remain around 10% in 2025. However, there may be a short-term boost in sales as consumers rush to take advantage of tax credits before their phase-out. China continues to dominate global EV adoption, with battery electric vehicles (BEVs) expected to reach 30% market penetration by 2025. When including hybrids and extended-range electric vehicles (EREVs), the total electrified vehicle share in China

could approach 60% by 2025.

Our analysis suggests that EV costs will reduce by 2027 to near ICEV parity

Driven by expensive powertrains and high overheads, high EV production costs are the primary barrier to adoption. While EVs in the US and the European Union (EU) still command a 20-25% premium over their internal combustion engine vehicle (ICEV) counterparts, China has already achieved price parity, with EVs often pricing below comparable ICE vehicles. High costs stymie EV adoption by putting off potential customers. This prevents automakers from being able to produce budget vehicles, makes EVs more dependent on subsidies and raises insurance costs and depreciation rates.

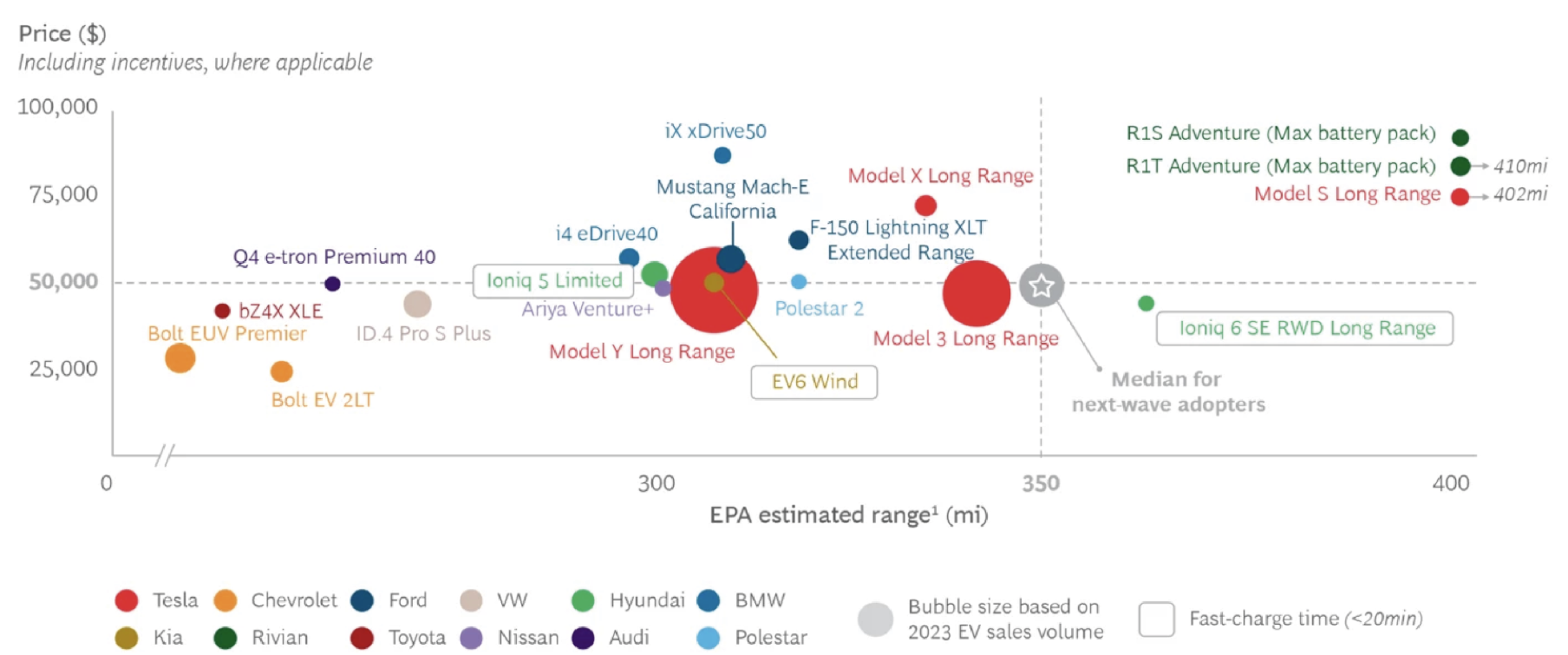

Figure 1: Only one EV on the market in the US meets customers, median price, range and charging time needs

We estimate that over 80% of this cost gap between EVs and ICEVs is driven by higher powertrain and overhead costs. The difference in powertrain costs is primarily driven by expensive EV batteries, while higher overhead costs per unit stem from high EV research & development (R&D) expenses, lower sales volumes and lower utilisation rates of production facilities.

Figure 2: Comparing EV and ICEV costs for US economy passenger cars, using 2022 cost base. The bottom table shows the proportion of the 18% cost difference that is attributed to each cost item difference

Sources: BNEF, ICCT, Columbia Threadneedle analysis2

We identified 16 cost reduction levers that automakers are using to reduce EV upfront costs and grouped these into four buckets (see Figure 3).

1) Reduced range anxiety – improve EV charging speed and provision to ameliorate range anxiety concerns, which reduces the size and cost of the vehicle battery pack.

2) Vehicle efficiency – enhance vehicle efficiency by improving aerodynamics and lowering vehicle weight, which also reduces the size and cost of the vehicle

battery pack.

3) Lower battery costs – reduce battery pack costs directly by adopting different sourcing models for batteries and critical minerals, adjusting the battery chemistries used and streamlining battery packing.

4) Limit non-battery costs – increase volumes and reduce costs such as manufacturing, overheads and powertrain costs.

We conducted a bottom-up analysis of how these levers can lower EV costs, using a combination of data and analysis from academia, industry and collaboration with our fundamental analysts. We then assessed how much of this potential cost

reduction could be realised in the next two to three years with new EV platform releases.

We estimate that EV costs will come down by approximately 20% by 2027, bringing EVs close to cost parity with ICEVs. We project that adjustments to battery chemistries, enhancements of battery pack densities and improvements of powertrain cost efficiency could have the largest impacts on lowering EV costs.

Figure 3: Evaluating levers to reduce EV costs by 2027 for Western OEMs

Cost | % |

|---|---|

Indirect overhead | 8.20% |

Powertrain | 7.10% |

Body | 1.60% |

Electronics | 0.80% |

Chassis | 0.40% |

Interior | 0.00% |

Assembly labour costs | -0.20% |

Source: Columbia Threadneedle Investments

We expect policy support to continue driving EV penetration in China and Europe

The policy environment for EVs varies significantly across major markets. In Europe, recent changes to fleet emissions standards now allow manufacturers to average their compliance targets over 2025-2027, providing some flexibility for original equipment manufacturers (OEMs) struggling with the transition. While this

may slightly slow EV penetration in the near term, other initiatives, such as potential corporate fleet electrification requirements, could provide new growth drivers.

China maintains strong regulatory support for EVs, with a significant $11 billion cash-for-clunkers scheme extension for 2025 that could support approximately 1.1 million new BEV sales. This represents about 20% of BEV sales and could be further

enhanced by additional economic stimulus measures.

The US policy landscape has become less supportive. The likely phase-out of point-of-purchase EV credits will impact major manufacturers, particularly affecting Tesla, GM, and Ford through the 30D credit removal, and European manufacturers through the 45W credit phase-out. While the 45X battery manufacturer credit is expected to continue, the freezing of vehicle emissions standards at 2020-2021 levels will also slow electrification.

Chinese EV makers still have a competitive edge and will increasingly take market share

Chinese automakers have very competitive EV product offerings on both a technology and a cost basis. The recent Shanghai auto show demonstrated that Western automakers are frantically looking to leverage R&D and partnerships in

China to bridge the gap, but leading Chinese companies will continue to have an advantage over the short term.

We expect Chinese automakers to gain most share in Southeast Asia and the Middle East, where auto import tariffs are lower and there are no domestic champions to protect. Japanese OEMs are already losing significant share in these

markets. In contrast, Russia, Mexico and Brazil have been significant export markets in recent years, but are raising their import tariffs, which will strengthen incentives for Chinese automakers to localise production.

In Europe we see significant hurdles to Chinese automakers rapidly gaining share, contrary to some market projections. EU tariffs introduced in 2024 have already caused Chinese auto exports to the EU to decline by 7%. We also see EU efforts to encourage Chinese EV technology sharing and forthcoming cybersecurity rules as additional barriers. In addition, production plans by Chinese manufacturers in Europe have flattered to deceive, with only BYD and Geely committing to produce significant volumes to date.

Stock spotlight

BYD: driving innovation forward and costs down

Our strong conviction in BYD’s market position and growth potential has led us to initiate or expand positions in the company in several of our funds in 2025. BYD’s exceptional vertical integration capabilities create substantial cost advantages and supply chain resilience, setting it apart from competitors. BYD’s technological leadership is supported by its massive R&D team of 110,000 engineers, and is evidenced by breakthrough innovations like its five minute charging technology for 400km range and the standardisation of its God’s Eye intelligent driving system across its mass-market vehicle lineup. The company’s strategic approach to global expansion, particularly its early moves to establish local production facilities in Hungary, Turkey, Brazil, and planned operations in Mexico, positions it uniquely among Chinese automakers to navigate international trade barriers. This manufacturing flexibility, combined with its technological edge and cost leadership, makes BYD particularly well-equipped to capture market share in both developed and emerging markets.

The mention of any specific shares should not be taken as a recommendation to deal. Information correct at the time of publishing.

EV charging surging in China and Europe

As EV upfront costs continue to fall, we see charging becoming the main barrier to EV penetration. However, the outlook for EV charging is positive, particularly in China and Europe. China accounted for 68% of installed EV charging capacity by the end of 2024 with charger deployment keeping pace with EV sales, while efforts by BYD and CATL has slashed top-end charging times to five minutes. Europe has made substantial progress, reaching one million public chargers in 2025, with installation rates growing at 33% year-over-year. Particularly encouraging is the rapid expansion of ultra-fast chargers, which represented 20% of new installations in 2024, with installation rates doubling annually. Recent improvements have been driven by a notable decline in the prices of fast chargers, with costs falling by 80% since 2020. The outlook for the US is less positive, with only 4,000 public chargers installed in Q4 2024 and the pause in Federal charging funds under the new administration set to slow deployment.

The bottom line

The EV landscape is evolving rapidly, with the swift pace of technological innovation shifting competitive advantages. While we do not expect the transition to move at the same pace globally, and we continue to see charging infrastructure as the largest barrier, the steady march towards vehicle electrification appears irreversible. Chinese manufacturers, especially BYD, are well-positioned to capitalise on this transition with their strong technological advantages and low-cost bases, though their success in different markets will vary based on local conditions and trade policies. We do think that there is space for the best Western automakers to succeed when they combine a precise focus on key technologies with strategic flexibility.