Market Monitor – 27 September 2024

Global stock markets made solid advances this week, as a slew of positive news drove share prices higher.

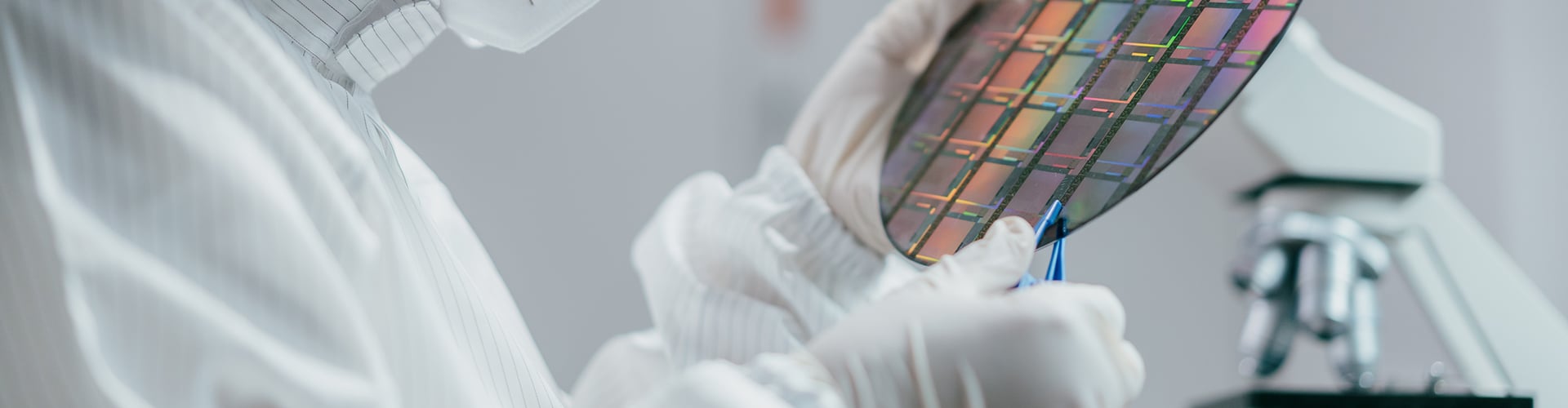

Can the demand for critical minerals be met responsibly?

Solar, wind and batteries all rely on critical minerals. Will the race to unearth them drive innovation or lead to unsustainable practices in global supply chains?

Market Monitor – 20 September 2024

Global stock markets suffered heavy losses this week as concerns about the health of the US economy re-emerged.

How does board gender diversity affect stock risk?

Companies with insufficient board gender diversity have higher idiosyncratic risk, so how can portfolio managers go about mitigating this?

Market Monitor – 13 September 2024

Global stock markets suffered heavy losses this week as concerns about the health of the US economy re-emerged.

Columbia Threadneedle Sustainable Outcomes Global Equity Strategy Q2 update

News and views on the issues impacting the world of sustainable investing, including the US Inflation Reduction Act and record global temperatures, and a focus on ‘our ageing world’.

Market Monitor – 6 September 2024

Global stock markets suffered heavy losses this week as concerns about the health of the US economy re-emerged.

Market Monitor – 30 August 2024

Global stock markets enjoyed a largely positive week after data provided further evidence that the United States economy remains in relatively good health.

CT Responsible Global Emerging Markets Equity Strategy – Responsible Profile 2023

Learn how we engage to understand and encourage improvement in companies’ management practices of ESG issues

Europe better placed than America… and cheaper

In the US, weakening employment poses risks to both consumer expenditure and growth, while in China both the consumer and the property market are at risk.