CT UK High Income Trust

Aiming to provide an attractive level of income together with the opportunity for capital growth.

An introduction to the Trust

The Trust aims to provide income as well as capital growth, by investing in predominantly UK companies of all sizes

The share price information is delayed by at least 15 minutes

David Moss is a Senior Portfolio Manager and Head of European Equities Research Strategy. He manages the CT (Lux) European Growth and Income Fund, the CT (Lux) European Sustainable Opportunities Fund and several Pan European and UK Income funds.

David joined the company through the acquisition of BMO GAM (EMEA) in 2021, having been with BMO and its predecessor companies since 1996. He worked as a fixed income analyst and has focused on Pan European equities since 1999. David began his career in 1987 at Barclays as a corporate lending analyst. He holds a BSc in Economics from the Loughborough University. He holds the ACIB and IIMR qualifications and is a member of the CFA Society of the UK.

CT UK High Income Trust aims to provide shareholders with an attractive level of income together with the opportunity for capital growth.

The Trust invests predominantly in UK equities.

To simplify the Company’s listing structure, the Company has cancelled the admission of its Units to trade on the London Stock Exchange. Investors can continue to trade in Ordinary Shares and B Shares.

Find out more

Key documents

- CT UK High Income Trust PLC - Ordinary Shares KID

- CT UK High Income Trust PLC - B Shares KID

- Factsheet

- Factsheet – B Shares

- Latest Interim Report & Accounts

- Latest Annual Report & Accounts

- Investor Disclosure Document

- CT UK High Income Trust PLC - AGM Polling Results July 2025

- Kepler Report

- Letter to Main Register Unit holders February 2024

- Letter to Savings Plan Unit Holders February 2024

Let's talk about risk

The value of your investments and any income from them can go down as well as up and you may not get back the original amount invested. Investments which are concentrated in a specific sector or country may result in less diversification and hence more volatility in investment values. Gearing is used for investment purposes to obtain, increase or reduce exposure to an asset, index or investment. The use of gearing can enhance returns to investors in a rising market, but if the market falls the losses may be greater.

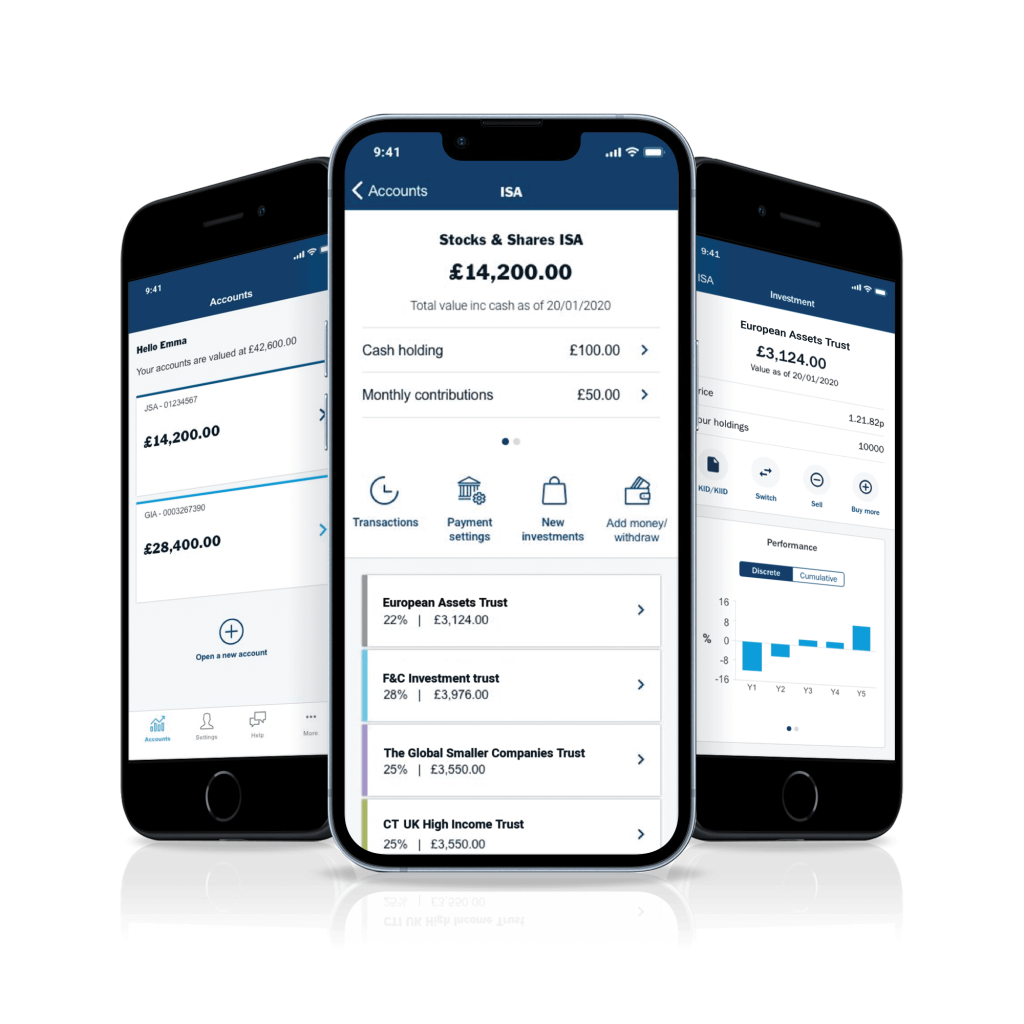

Invest with Columbia Threadneedle Investments

Columbia Threadneedle offer a range of Savings Plans designed to make investing easy.

Start investing from £2,000 for an adult account and £1,000 for a child account. Regular monthly contributions can be made from £25 or one-off additional investments from £100 after the minimum opening investment has been made. There are no dealing charges when you deal online.

Information in this section of the Website is directed solely at persons who are located in the UK and can be categorised as retail clients. Nothing on this website is, or is intended to be, an offer, advice, or an invitation, to buy or sell any investments. Please read our full terms and conditions and the relevant Key Information Documents (“KID”) before proceeding further with any investment product referred to on this website. This website is not suitable for everyone, and if you are at all unsure whether an investment product referenced on this website will meet your individual needs, please seek advice before proceeding further with such product.