When the Covid-19 pandemic reached Europe earlier in the year, the impact revealed a lot about some of the continent’s best-known companies. Philips doubled its production of ventilators while L’Oreal1 began to mass produce hand sanitiser.

Both companies reacted decisively to the crisis, showing strong management and adapting quickly to changing market conditions to benefit society.

Selecting high-quality companies such as Philips and L’Oreal is at the heart of the way we have always managed the Threadneedle (Lux) Pan European Equities Fund. By combining financial and non-financial (environmental, social and governance – ESG) research, we give our stock selection an even sharper edge, which we believe can lead to even better investment performance.

For that reason we are moving to embed ESG analysis formally in the investment process. We will weight decision making equally between financial and non-financial research, further enhancing our understanding of management quality and the sustainability of business models.

Incorporating ESG factors in the remit of the fund is a natural evolution. For more than five years we have increasingly focused on companies with sustainable competitive advantages and strong operating practices. We have also increased the intensity of ESG analysis over the past 18 months, and this has boosted outperformance.

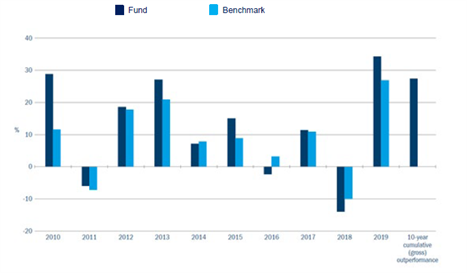

The Pan European equities strategy has shown exceptional resilience during one of the most testing times ever for stock markets. Over one year to end-April 2020 it fell 4.3% (net of fees) compared to a fall of 11% for the MSCI Europe index2this outperformance coming mainly from our stock selection skills. Longer-term figures show this is not a short-term trend, as we have demonstrated outperformance over the past decade (Figure 1).

Source: Columbia Threadneedle Investments. Gross Fund returns are in-house calculated daily time-weighted based on global close valuations with cash flows at start of day and are gross of fees. Past performance is not a guide to future performance. Figures correct as at July 2020

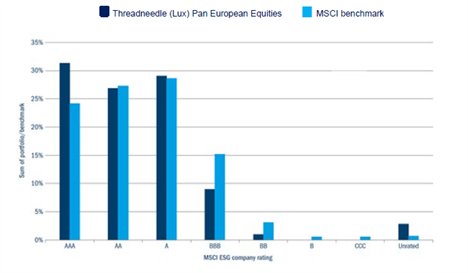

To mark the change, on 2 October 2020 we will rename the fund Threadneedle (Lux) Pan European ESG Equities. Its portfolio already boasts a carbon footprint much lower than the MSCI Europe Index and holds more companies with the top MSCI ESG ratings than the benchmark (Figure 2), and we are committing to maintain this record. We will avoid investing in companies which pollute excessively or exhibit poor governance. We will engage more with management on ESG issues and continue to vote the shares we hold to encourage positive change.

ESG analysis will be at centre of how we evaluate a company and is part of our investment DNA. While previously it was the domain of the responsible investment (RI) team, now portfolio managers join the calls they have with companies. Understanding the factors underlying ESG – whether environmental pollutants, treatment of employees or evaluation of the supply chain – has proved essential not just for judging whether a company is a good corporate citizen, but also whether it can and will create shareholder value.

Source: MSCI/Columbia Threadneedle Investments, June 2020

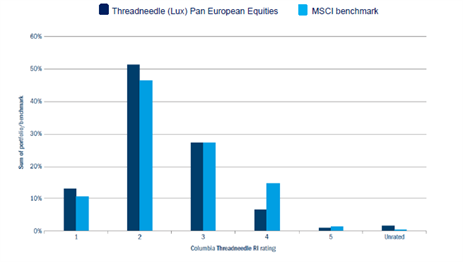

Our RI analysts are based in London and Minneapolis and as a firm Columbia Threadneedle has developed unique RI ratings that bring together ESG and financial stewardship data, enabling us to assess the quality and sustainability of companies (Figure 3). Quality and sustainability lie at the heart of our approach.

Unlike other ESG ratings, ours address the most material ESG issues, including accounting and financial stewardship. Better-rated companies (ranked 1) tend to outperform and the worst-rated (ranked 5) underperform – we have evidence of this through back-testing, so the ratings are a proven aid to our research and risk discovery.

Source: Columbia Threadneedle Investments, June 2020

During the recent market volatility, combining financial and non-financial analysis has served our clients well. We own Lonza, which is developing treatments and hygiene products for Covid-19, as well as Novo Nordisk and Grifols, shares which have both hit all-time highs this year. We have also held healthcare firm Roche, and Eurofins, a medical devices company that has developed Covid-19 tests.

While the market is still assessing the long-term consequences of the pandemic, it has made ESG issues – particularly the significant social impact of Covid-19 – even more important for financial prosperity. Regulations and oversight covering emissions and social responsibility are likely to grow.

In many ways, formalising our mandate is just recognising the inevitable. We have always focused on high-quality companies with a strong competitive advantage, pricing power and high barriers to entry. Now, ESG-related issues are increasingly part of this new economic reality – encompassing both risks and opportunities. For tomorrow’s winners, they help create and boost economic returns, and we are committed to being a part of that.