- Equity markets quite quickly found a bottom around late March, shortly after China reported no locally spread infections for the first time since the Wuhan outbreak. For investors in Asia, this was an important signal that the disease spread could be suppressed.

- The shift online of both corporate and consumption activities saw hardware and software technology rise to the occasion, accelerating trends that were already in motion pre crisis. The strength of China’s online ecosystem, which is heavily represented in the China Index, helped support a return to positive economic growth in Q2 as production started to return after the spread of Covid-19 was brought under control. As such, for the full year China is likely to grow 2% in 2020, outperforming developed nations by a wide margin.

- The Trump administration’s continued adversarial approach towards China, including exerting pressure on US allies to stop using Huawei 5G equipment, and measures aimed at restricting supply chains of high-end semiconductor chips and equipment to Chinese companies, forced China to embark on a push towards supply chain self-reliance, particularly in high-tech components.

- Joe Biden’s presidency should see the return of professional US diplomacy, with the effort to “heal America” spilling over to the rest of the world, including in US-China relations and China-Australia relations, though some damage may remain.

If I were to sum up Asia ex Japan equity markets in 2020, it would be the pain of negative headwinds followed by the triumph of human ingenuity and determination in rising above them. This perhaps seems too optimistic a story for such a year, given how the world has suffered from Covid-19, but not too far-fetched if the performance of equity markets can be submitted as a verdict.

Pandemic pain

Equity markets quite quickly found a bottom around late March, shortly

after China reported no locally spread infections for the first time since

the Wuhan outbreak. For investors in Asia this was an important signal

that the disease spread could be suppressed. The pandemic’s impact in

the US brought forth strong monetary stimulus, which facilitated central

banks in Asia to do likewise without fear of severe currency weakening.

This sparked fresh optimism.

The prospect of a post-pandemic recovery should see very strong economic performances across the world, with Asia’s growth again anchored by China

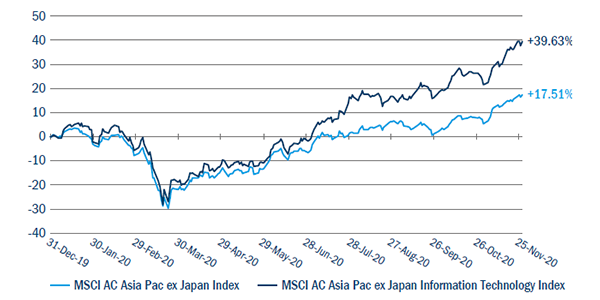

The shift online of both corporate and consumption activities saw

hardware and software technology rise to the occasion, accelerating

trends that were already in motion pre crisis. As a result, the information

technology sub-index grossly outperformed (see Figure 1), resulting in

the strong performances of the Taiwan and Korea equity indices.

Figure 1: Long-term global IG corporate spreads

Source: Bloomberg, December 2020.

The strength of China’s online ecosystem, which is heavily represented

in the China Index, helped support a return to positive economic growth in

Q2 as production started to return after the spread of Covid-19 was brought

under control. As such, for the full year China is likely to grow 2% in 2020,

outperforming developed nations by a wide margin.

Not all Asia economies fared as well, however. Those countries more

heavily reliant on tourism, such as Thailand, suffered badly. India,

Indonesia and the Philippines also had difficulty keeping infections in

check, while lacking the benefit of a more buoyant online ecosystem to

facilitate continuing commercial activities where people movement had

to be curtailed.

Political hostilities

The Trump administration continued its adversarial approach towards

China, including exerting pressure on US allies to stop using Huawei 5G

equipment, and measures aimed at restricting supply chains of high-end

semiconductor chips and equipment to Chinese companies. This forced

China to embark on a push towards supply chain self-reliance, particularly

in high-tech components.

This forms part of China’s broader “dual circulation” strategy targeted at

increasing the reliance on its own demand for sustaining economic growth.

Other aspects include the promotion of domestic travel and strengthening

the quality of local brands to compete with premium foreign goods.

Notably, it does not mean moving away from China integrating itself into

the global trading network, with the China-led Regional Comprehensive

Economic Partnership (RCEP) successfully signed in November with

the 10 South-east Asian countries, South Korea, Japan, Australia and

New Zealand. China is also considering joining the Comprehensive and

Progressive Agreement for Trans-Pacific Partnership (CPTPP), which

replaced the Trans-Pacific Partnership (TPP) following US withdrawal

under Trump’s “America first” pivot.

Climate change

China’s climate change efforts also forged ahead during the year, with

stocks linked to electric vehicles (EVs) and solar energy capping a stellar

year for equities. These stocks should continue to do well in 2021 under

President-elect Joe Biden as he seeks to turn the US back towards the

climate change agenda in the next four years.

2021: potentially more win-win outcomes

In geopolitical terms, Biden’s presidency should see the return of

professional US diplomacy, with the effort to “heal America” spilling over

to the rest of the world, including in US-China relations and China-Australia

relations, though some damage may remain.

China’s climate change efforts forged ahead during the year, with stocks linked to electric vehicles and solar energy capping a stellar year for equities

The prospect of a post-pandemic recovery should see very strong

economic performances across the world, with Asia’s growth again

anchored by China where the street and the World Bank is expecting

around 8% real GDP growth.1 Against this backdrop, 2021 should be

another strong year for equities, whereby sectoral performances are less

bifurcated. Non-tech sectors should rebound strongly, but tech stocks

will also perform as themes such as 5G, artificial intelligence, big data,

EVs, cloud computing, ecommerce and video live-streaming still have

lots of momentum.