The conflict between Russia and Ukraine exposed Europe to an energy shock without precedent, exacerbating an environment of already high energy prices and creating an energy supply crisis. The EU receives around 40% of its gas from Russia, so in response to this crisis it unveiled in March an energy plan called “RePowerEU”. Its aim is to reduce Europe’s gas dependence on Russia by two thirds by the end of 2022 and to zero by 2030.1

The plan aims to ensure energy security while moving forward on decarbonisation, primarily from a material acceleration of renewables and energy efficiency measures.

The plan, therefore, is aligned with the European Green Deal and the goal is to achieve both objectives in parallel with measures to allow faster permitting for renewables which we see as a key catalyst to achieving the expansion of clean energy. RePowerEU could, therefore, bring forward investment in additional renewables capacity as well an increased focus on energy efficiency.

What’s the plan about?

The plan sets out a combination of objectives and measures for the short, medium and long term:

- In order to reduce dependency on Russian gas by two thirds, the EU is looking to diversify gas imports, particularly via higher LNG imports from the US. Late in March, the EU and US announced a task force which will see the US strive to ensure additional LNG volumes for the EU market of at least 15 billion cubic meters (bcm) in 2022 2 – although specifics on how they will do this were not provided.

Considering that US LNG is already at full production and increasing production will take a few years to build out, the announcement is perhaps more of a strategic agreement to ensure the US/EU natural gas relationship and the long-term growth of exports to Europe, rather than a concrete plan.

EU member states could also use temporary short-term regulatory measures to counteract rising power prices, such as windfall payments. However, the most significant development in this space so far is the announcement that Spain and Portugal will be allowed to temporarily decouple electricity prices from that of gas.3 Both countries already have very high renewable electricity generation and are almost completely detached from the rest of the EU energy market due to few interconnections, and both only import around 10% of gas from Russia (versus around 55% for Germany, for example).4

Risks, opportunities and uncertainties

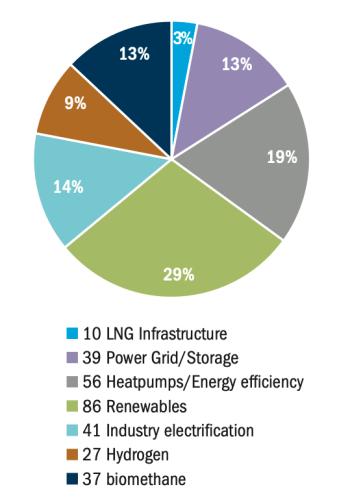

Figure 1: RePowerEU funding (€bn)

In addition, the hydrogen upgrade will provide upside for European electrolyser OEMs (original equipment manufacturers), while an acceleration of US shale and global LNG (Liquid Natural Gas) construction will benefit companies in the LNG gas supply chain.