Julian Cane has been the portfolio manager of the CT UK Capital and Income Investment Trust since 1997, making him one of the longest-serving managers in the sector. Over nearly three decades, he has followed a disciplined and selective investment approach, focusing on companies he believes have strong fundamentals, capable management, and attractive valuations. We spoke with Julian to better understand his Investment Philosophy and Process, enjoy.

Q: Could you outline the Company’s investment objective?

A: The Company’s objective is to secure long-term capital and income growth from a portfolio consisting mainly of FTSE All-Share companies. The Company aims to offer Shareholders a reliable and growing income while at the same time seeking to grow the size of their investment.

Q: What is your investment philosophy?

A: I have managed the Company for over 27 years. Throughout that period, my colleagues and I have been searching out the very best of

the UK’s large and medium sized businesses to give Shareholders access to a range of quality UK stocks in one place. We believe share prices often don’t fully reflect the future prospects and returns of companies. We believe it is possible to identify significant differences between market prices and our assessment of a business’s value. By investing in such companies at attractive prices, we aim to deliver strong investment returns over time. In particular, we believe that companies with the potential to compound returns at sustainably high rates over many years are frequently underestimated by the market initially and are therefore undervalued. The valuations of companies can also become attractive because of adverse market reaction to short term difficulties or simply because a sector has become unfashionable. If companies are able to generate attractive returns over long periods, there is evidence the market eventually rewards this success with higher valuations.

Q: What are the outcomes of this philosophy?

A: We believe that this philosophy leads naturally to long term investment thinking and the generation and preservation of value over the longer term. We are not looking to trade shares, nor are we making short term bets on market movements, but instead are looking to the longer term. Over time, we expect high corporate returns to drive an increase in the value of a business and that in turn the share price will benefit as the market recognises the level and sustainability of those returns.

As shareholders, we are part owners of businesses, and take our responsibilities seriously, engaging with the company’s management

and non-executives if necessary, and voting on all resolutions at company meetings.

Q: What is your approach to risk?

A: Risk is often seen as the flipside of return. The standard economic and business academic approach to risk measures it in terms of volatility. Sharp upward moves in share prices are seen as just as “risky” as an equivalent downward move, but we recognise this asymmetry doesn’t make practical sense as the result of losing money on falling share prices is much more consequential than if a share price rises. By investing in companies with attractive returns and relatively little debt, we aim to reduce the risk of a permanent loss of capital.

Q: What research is undertaken prior to an investment purchase

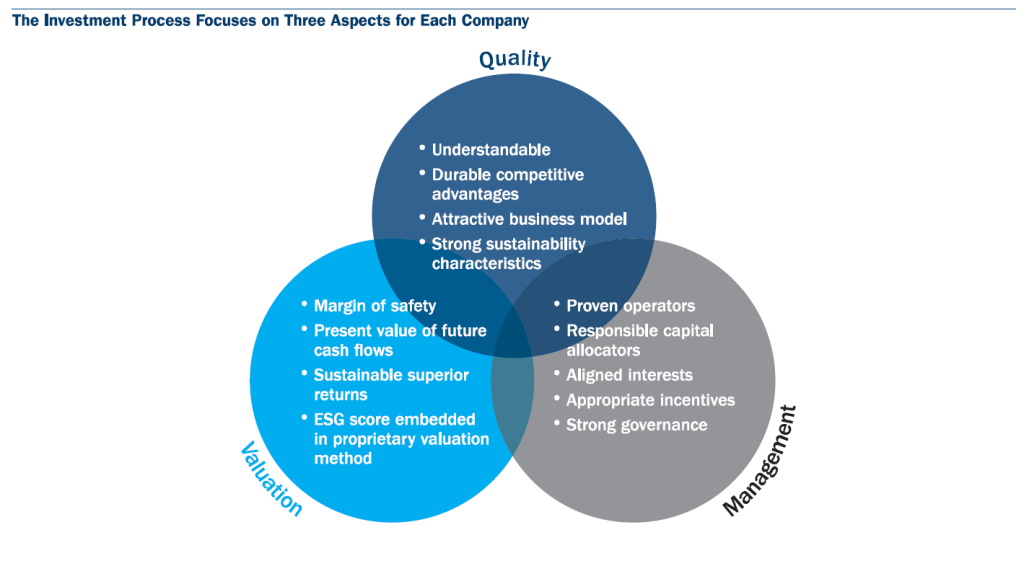

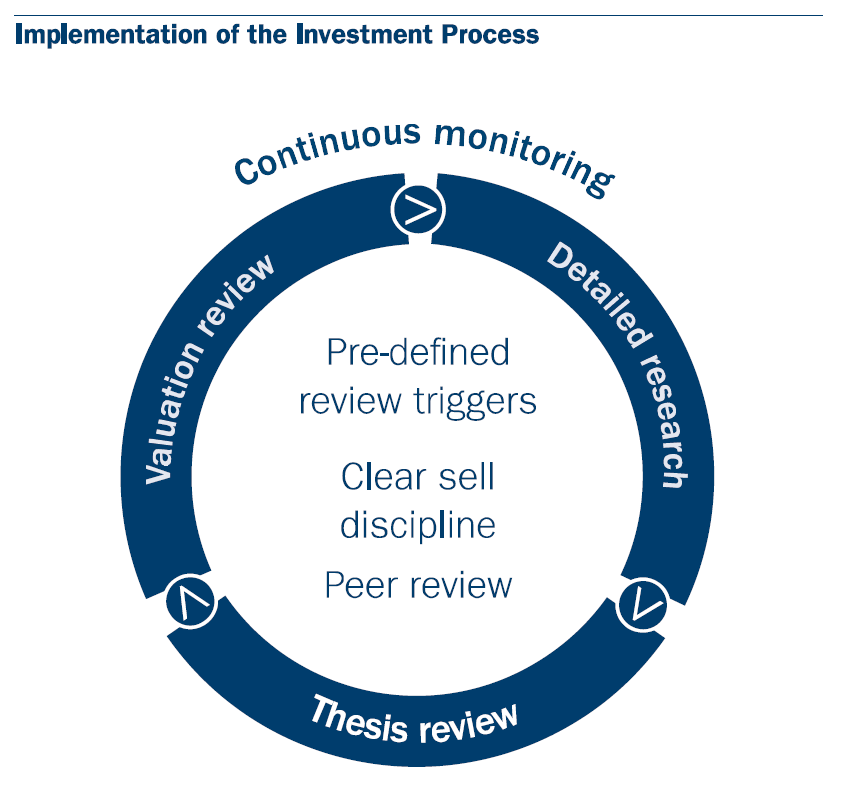

A: We carry out detailed analysis of all the companies in which we invest, looking in particular at three aspects: the Quality of the company including the sustainability of its competitive position; its Management including its alignment with Shareholders; and the Valuation of the shares. Integral to our assessment of these factors is an analysis of the ESG issues that face the company and its responses to them. Our valuation approach is pragmatic enough to apply the most relevant valuation method on a company by company and sector by sector basis, while recognising that in the long-term, cash flows are most often the strongest driver of value. Before buying, we assess whether the share price is low relative to the intrinsic value of the business as we are looking to achieve a margin of safety on the investment. Our research is conducted in-house and is peer reviewed by the wider investment team prior to any purchase decision. This ensures the benefit of shared knowledge and experience is brought to bear on each investment.

Q: How is an investment monitored after purchase?

A: Subsequent to a purchase of the shares, the progress of the company and its share price will then be monitored regularly with in-depth reviews and retesting of the original investment thesis particularly if the company or its share price do not perform as initially expected.

Like all investors, we are having to make assessments about the future and take decisions in the face of uncertainty. There is a real possibility of being wrong. We believe that we can mitigate this risk by following this long-term philosophy, emphasising a number of factors: thorough analysis; peer review; the need for a margin of safety on purchase; continuous monitoring; and diversification of the investment portfolio.

Reasons to sell can be driven by positive or negative factors: positive, if the value of the company has risen to our assessment of its value, or negative, if the assessment of the company’s long-term value deteriorates significantly. An investment may also be sold if, for example, a similar, but cheaper alternative can be found or if the size of the investment position has become larger than is preferred for risk purposes.

Let's talk about risk

The value of your investments and any income from them can go down as well as up and you may not get back the original amount invested. Tax allowances and the benefits of tax-efficient accounts are subject to change and tax treatment depends upon your individual circumstances. Each Trust has different risk factors. Please see the Key Information Documents (KIDs) for further details on the risks for each trust.