CT Junior ISA

Tax efficient savings for your child

A Junior Individual Savings Account (JISA) is an account that acts as a wrapper to hold savings or investments for children aged under 18. JISAs allows you to invest up to £9,000 in the 2025/26 tax year, with no tax on any growth or dividends paid. At Columbia Threadneedle, we offer a stocks and shares ISA.

The CT Junior ISA (CT JISA) lets you tap into the potential of the stock market and the skills of our fund managers to potentially help your child with those future goals, such as university fees, a deposit on their first home or that dream trip around the world.

CT Savings Plans can help longer-term investors that intend to keep their money invested for at least five years. The opening investment amount of £1,000 for a CT JISA helps ensure investors with smaller sums to invest can get value for money and reduces the risk they receive a poor financial outcome.

Reasons to choose Columbia Threadneedle for a CT Junior ISA

No online dealing charges

Benefit from our expertise

Responsible investing

Cost-effective investing

Getting started is easy

3 steps toward

your goals

Choose a savings plan

Choose your strategy

Invest in your future

Let's talk about risk

Like all investments, our Stocks and Shares Junior ISA comes with a level of risk. Because the money in the account is invested in stocks and shares, the value of your investments can both rise and fall. That means your child might get back less than you originally put in. A Junior ISA account is available to any child under the age of 18 who lives in the UK, unless they have a Child Trust Fund – in which case, they won’t be eligible. Remember, a Junior ISA belongs to the child. Only they can withdraw the funds when they turn 18, so consider this savings product a long-term investment. Be aware that tax rules may change in the future, and tax treatment depends on your child’s individual circumstances.

A cost-effective way to invest

Invest up to £9,000 in the 2025/26 tax year. Our CT JISA features a flat annual fee of £25 + VAT (£30), regardless of how much you invest. A Government stamp duty of 0.5% applies on the purchase of UK shares.

You can start investing in a CT JISA with an opening investment amount of £1,000. Once you have deposited the opening investment amount, a Direct Debit can be arranged from as little as £25 a month. You can also make one-off investments at your convenience from £100.

Accounts can be opened by post and an application form is located in the Document Library.

There are no dealing charges payable for Direct Debits or online one-off contributions, sales, and switches. If you send instructions in the post, there is a £12 charge for each fund selected.

Friends and family can gift money to your child’s account too – whether they are grandparents, godparents, or friends.

Please read the pre-sales costs disclosure, Key Features Document and Terms & Conditions before you invest. You will need to sign a declaration on our forms that confirm you have read these documents.

Transfer your JISA to Columbia Threadneedle

Switching your Junior ISA to us is easy, all you need to do is complete a transfer form and we will take care of the rest. The process will normally be complete in around four weeks although may take a little longer depending on your current provider.

You can transfer a stocks and shares JISA, or a cash JISA, to a CT JISA (or both, if you have one of each). Once we’ve received your transfer form, we contact your existing JISA plan provider and arrange the transfer for you.

Your JISA transfer should be for £1,000 or more. CT Savings Plans can help longer-term investors that keep their money invested for at least five years. The opening investment amount of £1,000 for a CT JISA helps ensure investors with smaller sums to invest can get value for money and reduces the risk they receive a poor financial outcome.

We only accept transfers as cash, and we can’t accept further contributions into the new CT JISA until your existing JISA manager has completed the transfer. Any transfers from an existing stocks and shares JISA must be done in full – you can’t make a partial or previous tax years’ transfer.

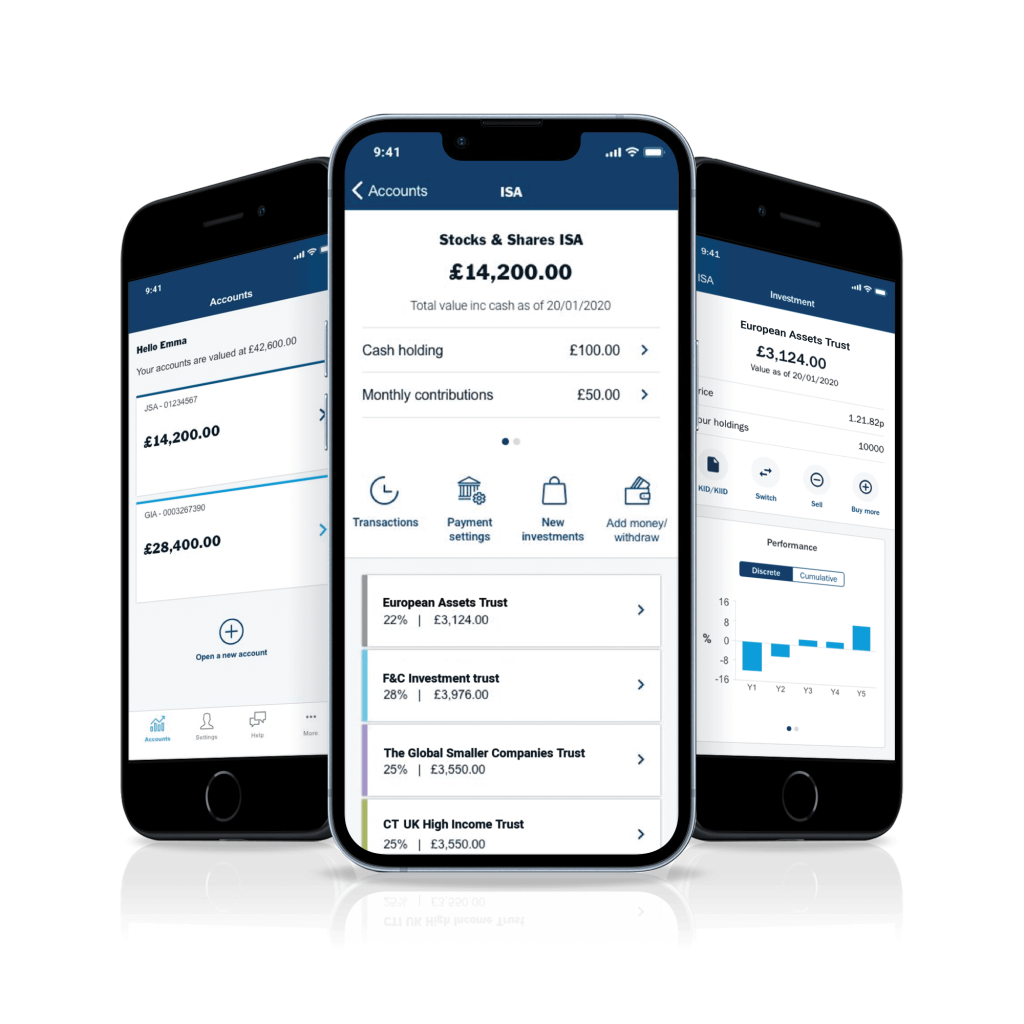

Invest in our Investment Trusts through a CT JISA

A Columbia Threadneedle Stocks and Shares Junior ISA allows you to choose from a diverse range of investment trusts. These trusts offer you different ways to invest, such as in equities, bonds, property, and private equity. Choosing a mixture of these trusts enables you to spread your investments and potentially minimise risk.

Each trust operates differently. You can pick options that focus on capital growth, income, or both. Some invest in the UK, while others take a global approach.

Please see the Key Information Documents (KIDs) for further details on the risks for each trust. View the latest performance of our Investment Trusts.

Invest now

Columbia Threadneedle offer a range of Savings Plans designed to make investing easy.

Start investing from £2,000 for an adult account and £1,000 for a child account. Regular monthly contributions can be made from £25 or one-off additional investments from £100 after the minimum opening investment has been made. There are no dealing charges when you deal online.

Frequently asked questions

You can open a Junior ISA for children (under 18) who live in the UK. Only parents (or those with parental responsibility) can open a Junior ISA for them.

If your child already has a CTF they cannot also have a Junior ISA. You can however, transfer a CTF into a Junior ISA. We’ll open your CT JISA for you as part of the transfer application process – simply download and complete the form and we’ll do everything else. It’s not possible to transfer a CTF to a Junior ISA online.

Grandparents, godparents, friends and relatives can all contribute to your child’s Junior ISA by using our Junior ISA top-up form. Only the Registered Contact is allowed to make investment decisions.

Until the child reaches 16 the parent who opens the account (Registered Contact) can choose the type of investments held. From 16, to help the child develop a more thorough understanding of how savings work, they can control the investment decisions should they wish – though they cannot make any withdrawals until they reach 18.

No, funds in the Junior ISA cannot be withdrawn until the child reaches 18.

There is no tax to pay on any return on your investment, including dividends or interest received. You’ll also pay no capital gains tax (CGT), which may be relevant if you have used up all your annual CGT allowance.