Investment Themes

The UN Sustainable Development Goals & Our Themes

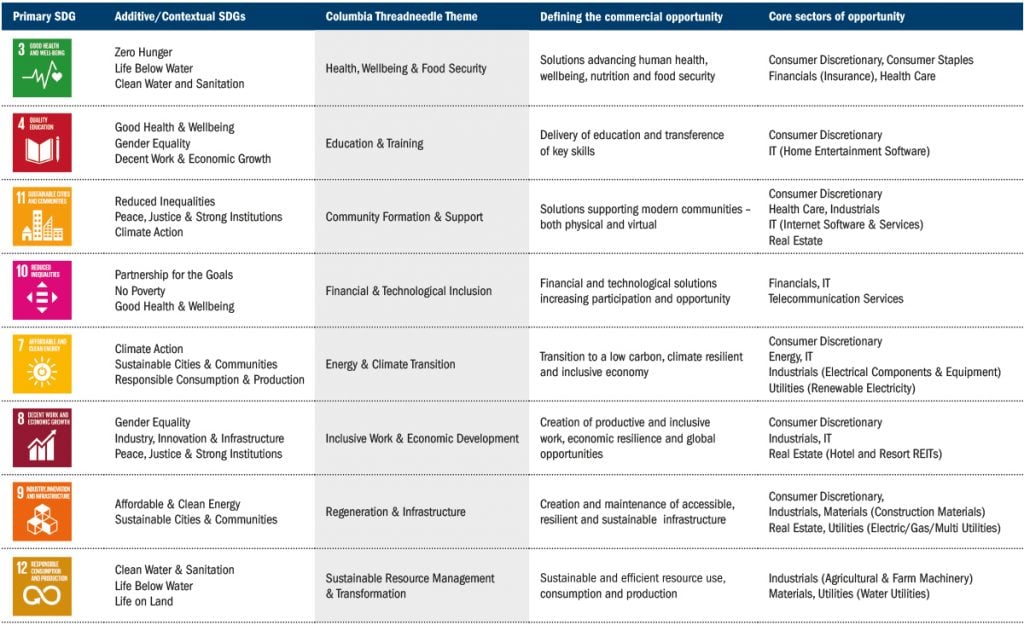

Translating the UN Sustainable Development Goals (SDGs) to investment opportunities provides us, our clients, and the wider industry, with a compelling means to contribute to sustainable development whilst aiming to achieve positive financial returns.

The UN Sustainable Development Goals

Frame a public policy agenda around which sustainable development policies, plans and programmes should be framed at a national level.

Provide investors across all regions with a thematic framework around which public policy, reform and development priorities will be focused, catalyzing demand for innovation and new or increased investment.

Help businesses align with global priorities: companies can use the SDGs as an overarching guide to shape and steer the development and implementation of their own strategies.

Create opportunities for investors to look at how they can productively allocate capital to organizations responding to this dynamic – e.g. through innovation and development of sustainable products, services and solutions.

Our sustainable & social themes

Are aligned with the UN Sustainable Development Goals (SDGs), translated for use in a financial markets context.

Look to identify and categorise companies based on commercialized outputs, products and services addressing major social and economic needs.

Not only help capital flow toward those issuers delivering positive change but offer potential strong sources of earnings growth and financial return – giving force to the notion of ‘doing well by going good’.

Columbia Threadneedle Investments Sustainable Themes

Note: Use of the SDG logos does not imply UN endorsement.

Insights

24 February 2026

Fixed income

In Credit Weekly Snapshot – Rip it up (and start again)

In Credit Weekly Snapshot – Rip it up (and start again)

On Friday, the US Supreme Court ruled that Donald Trump administration’s use of the

International Emergency Economic Powers Act to impose broad-based tariffs was unconstitutional.

23 February 2026

Multi-Asset

Multi asset

Senior Economist, Multi-Asset Solutions team

Market Perspectives: Tariffs 2.0? The options for President Trump

Market Perspectives: Tariffs 2.0? The options for President Trump

This week we focus on tariffs following last Friday’s US Supreme Court ruling that the current tariff regime under the International Emergency Economic Powers Act (IEEPA) is unlawful.

20 February 2026

Global investment solutions

LDI

Head of LDI Implementation

LDI market review and outlook – January 2026, Political risk to the fore

LDI market review and outlook – January 2026, Political risk to the fore

Despite political alarums jolting markets; regulatory change, political news-flow or war-mongering rhetoric; overall the impact on markets has been relatively benign.

Collaborative Insights and References

Aligned Columbia Threadneedle Investments Strategies

Social Bond Strategies

- UK Ethical & Sustainable Strategy

- Carbon Neutral Real Estate Fund

- European Sustainable Infrastructure Fund

You may also like

About Us

Millions of people around the world rely on Columbia Threadneedle Investments to manage their money. We look after investments for individual investors, financial advisers and wealth managers, as well as insurance firms, pension funds and other institutions.

Our funds

Columbia Threadneedle Investments has a comprehensive range of investment funds catering for a broad range of objectives.

Investment Options

We offer a broad range of actively managed investment strategies and solutions covering global, regional and domestic markets and asset classes.