- Prime Minister Yoshihide Suga to resign after a steady decline in approval ratings and the subsequent loss of backing from leaders in his party.

- Suga’s departure reduces the chance of an unfavourable outcome in the lower house election for the ruling party – there were concerns within the ruling Liberal Democratic Party (LDP) this could occur without a change in Prime Minister.

- Key contenders for his successor include: the increasingly popular vaccine minister Taro

Kono; former minister of foreign affairs Fumio Kishida; former internal affairs and

communications minister Sanae Takaichi; and former defence minister Shigeru Ishiba.

Given the weakened opposition, we still expect the LDP to retain power after the general election.

What happened?

After months of declining approval ratings, Prime Minister Suga announced that he will not run

for election as the ruling LDP leader and will thus resign as PM. In addition to mounting public

criticism over his response to the Covid-19 pandemic and pressing ahead with the Tokyo

Olympic Games despite the objections of health experts, a slew of defeats in the regional

elections have underscored the public’s discontent with the government.

Given the slumping approval rating of Suga’s cabinet, there were concerns within the party that it

would lose the lower house election without a change in Prime Minister. The news of his

resignation extended a rally in Japanese stocks that took the Topix index to a 30-year high.

The recycling of old clothes and shoes into new items is an increasing trend, as touched upon by global equities portfolio manager Pauline Grange in her recent viewpoint “Fashion eyes sustainability via the circular economy”. Alongside recycling, however, the rise of the re-use and second-hand market is poised to provide investors with an incredible opportunity: it is projected to double over the next five years to $77 billion4 and could be twice the size of fast fashion by 2030.

Who’s next?

There are currently three openly declared candidates: Fumio Kishida, the former foreign minister

who finished second to Suga in last year’s leadership ballot; Sanae Takaichi, the former internal

affairs and communications minister; and current vaccine minister Taro Kono. The ex-defence

minister Shigeru Ishiba indicated he is weighing a bid.

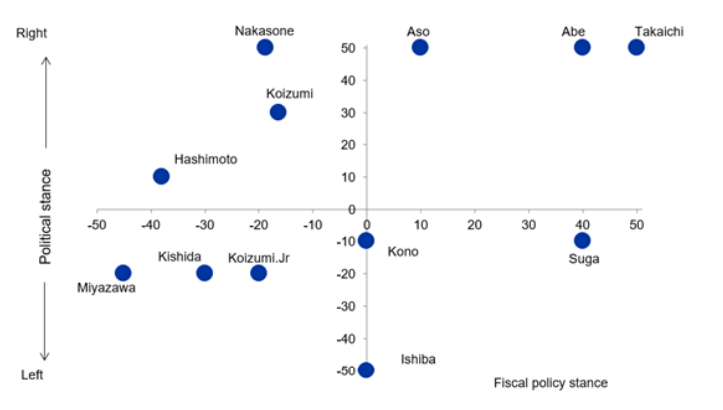

Figure 1: The political and financial stance of successive administrations

Source: Media reports, Ministry of Finance, SMBC Nikko. Political stance takes into consideration each person’s position on constitutional

amendment. Fiscal policy stance is expressed in the deviation range of -50 to +50 from the historical average ratio of fiscal spending/GDP.

From a market perspective, many investors and business leaders view Kono as a more

favourable candidate given his reformist views. He is a fluent English speaker with strong public

appeal who broadly favours more fiscal spending. Political analysts expect his bid to be

supported by Suga. Kono is currently the minister for administrative and regulatory reform and

played a key role in national pension system changes. He has also advocated cuts in health and

security spending which has surged as the population ages, while also proposing to accept more

foreign workers to address the labour shortage issue. In the past, he insisted the Bank of Japan

(BoJ) should communicate more clearly on an exit strategy from its ultra-loose policy.

Fumio Kishida is a former banker and lost to Suga in last year’s leadership election. Kishida has

pledged to maintain expansionary fiscal and monetary policies, although he has previously

voiced doubts over the BoJ’s excessively accommodative monetary policy. We can expect the market to favour his stance on economic policy, whereby he called for greater support of

companies in technology and innovation as he looks to create a “digitisation society.”

Furthermore, he has outlined plans to spend more than 30 trillion Yen in stimulus needed to

overcome the challenge from Covid.

Former internal affairs minister Sanae Takaichi has an economic policy very similar to that of

“Abenomics”, which includes a combination of bold monetary easing, use of fiscal resources in

emergencies, and spending on crisis management and growth. She said in an interview that

Japan should freeze the goal of achieving a balanced budget until inflation hits BoJ’s 2% target

and should not hesitate to issue government bonds as needed for crisis management. If she

became the new PM, the size of the fiscal stimulus would be larger than other contenders.

Shigeru Ishiba, a former defence minister, can be considered one of the weakest outcomes for

the market. He has supported more populist economic policies and advocated to revive

domestic demand (particularly in the regions) in order to drive growth, rather than relying on

foreign trade. He has also criticised the BoJ’s ultra-low interest rates and has previously

advocated to cut consumption tax.

Implications for the market

Despite the change in PM, the outlook for Japan’s political landscape should be viewed as

positive by investors as it is likely that a ruling coalition (LDP + Komeito Party) continues to hold

a majority. We expect the backbone of economic, foreign and fiscal policy to remain intact,

providing a strong tailwind for continued economic recovery.

Historically speaking, Japan’s equity market has been sensitive to the election for the House of

Representatives, which defines the administration’s stability going forward. In the case of the

LDP retaining its single majority, we can expect a strong market reaction. Providing the coalition

party doesn’t lose more than 72 seats – a scenario we now view as unlikely given the imminent

exit of the increasingly unpopular Suga – we can expect Japanese equities to perform

reasonably well given the global economic recovery, undemanding valuations and rising

vaccination rates. With the market historically performing well in the last 14 general elections

since 1979, we believe this could be a catalyst for Japan’s index to potentially catch up with the

US and Europe given the lag over the year.

We also remain constructive on the imminent supplemental budget announcement, expected to

be approximately 30 trillion Yen, which should further support the economy. We can also be

assured that regardless of the next PM, the BoJ’s monetary policy will remain accommodative in

the near term, at least until the current governor’s tenure ends in April 2023. Meanwhile, the

government is discussing the possibility of easing Covid restrictions in the restaurant and

entertainment industries. As social distancing measures are relaxed further, we can expect a pick-up in re-opening activities to support the service economy recovery.